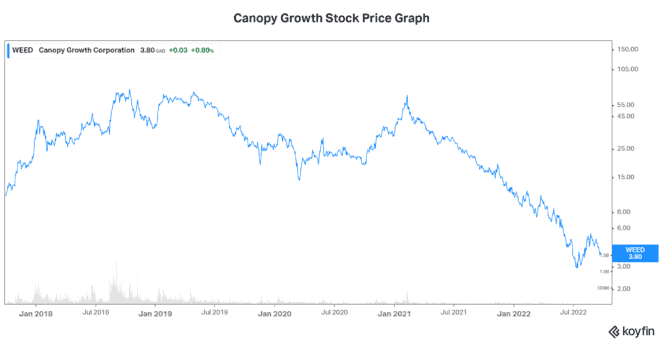

Inflation and declining stock markets are undeniably eating away at our collective wealth. But, hopefully, you have a little extra cash put aside. Because in the long run, today’s moves can help you come out on top — richer and better — because of the pain. Stocks like Canopy Growth (TSX:WEED)(NASDAQ:CGC) stock are trading well below recent highs. One would argue that there’s limited downside at this point.

Let’s discuss Canopy Growth stock as well as two other stocks to buy that are trading under $20. There are no guarantees, but these stocks hold plenty of upside potential to grow your money once again.

Canopy Growth: Revenue shows signs of stabilizing

Cannabis stocks were all the rage a few years ago. They traded higher on a hope and a dream. But, as all unrealistic dreams do, this one came crashing down hard. Canopy Growth stock began its descent in the spring in 2019. And although it struggled to maintain its highs, Canopy Growth stock never stood a chance.

Back then, the company and the cannabis industry was in disarray. Adjusting to this new industry would take more time than the market hoped. It would be characterized by write-downs, mounting losses, and company turnover. Ultimately, the stock had nowhere to go but down.

But after hitting highs of almost $70, Canopy Growth’s stock price is now settled at just under $4. Two things in particular have piqued my interest. Firstly, revenue seems to have stabilized. The latest quarterly revenue of $110 million was only 1% lower versus the prior quarter. Secondly, BioSteel, Canopy’s sports drink hydration segment, posted record revenue last quarter — up 169% — and it accounted for 16% of total revenue.

The immediate future looks bright for BioSteel, as it has secured a retail agreement with Walmart covering 2,200 stores in 39 states. It’s also the Official Hydration Partner of the NHL. This diversification will be an invaluable asset to Canopy and its stock price.

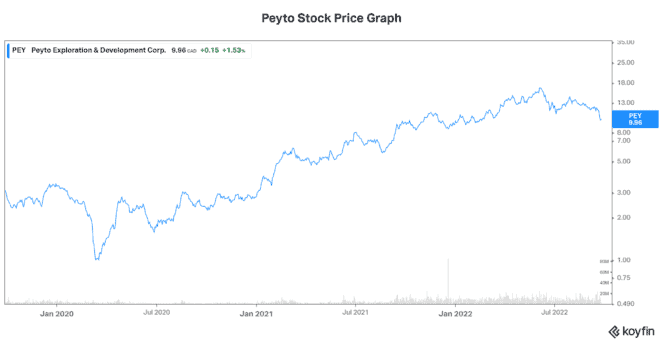

Peyto Exploration and Development: A generous dividend plus rapid growth

Peyto Exploration and Development (TSX:PEY) is a $1.7 billion natural gas producer. The company has a 5.9% dividend yield, as it trades at roughly $10. The stock was approaching $20 earlier this year, as natural gas prices soared past $9. Today, however, natural gas prices have come back down to under $7.

But this short-term weakness is not the end of the bullish natural gas story. As I’ve often discussed, natural gas has some very strong long-term growth drivers. This makes Canadian natural gas producers very attractive. For example, the macro environment is strong, with favourable supply/demand fundamentals. Also, the market for natural gas is quickly become a global one with the development of liquified natural gas (LNG) facilities. This means that Canadian natural gas is in high demand. As a relatively clean, reliable, and inexpensive fuel source, Canadian natural gas is like “gold” in the global market.

So, Peyto’s results are reflecting this favourable environment in 2022, with record earnings, cash flows, and dividends. For example, in the latest quarter, cash from operations increased 142% to $206 million. As a result of this major windfall, Peyto increased its quarterly dividend per share by over 1,000% to $0.15.

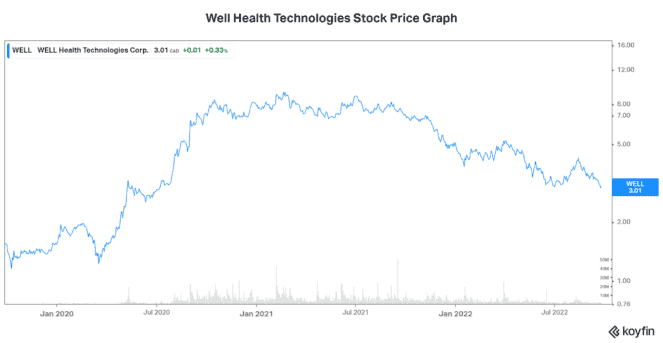

Well Health stock: The future of health care trading at value levels

Well Health Technologies (TSX:WELL) is an omni-channel digital health company. It’s driving the long-needed digitization of the healthcare system at a time when increased efficiency and productivity is most sorely needed.

Today, Well Health stock is trading at roughly a mere $3. This is a far cry from its 2021 highs of over $8. But for those investors that want a piece of this company, it’s a perfect time. Because while Well Health is currently reporting net losses, its cash flow generation and revenue growth is quite healthy. In its latest quarter, revenue increased almost 130% to $140 million. Even more impressively, operating cash flow increased 450% to $33 million. This trend should translate into solid future gains for Well Health stock.