Cheap stocks can be incredibly hard to find these days. Sure, practically every stock on the TSX today looks cheap. But are they really? There are a number of factors investors should consider before looking at stocks. And I’m going to go over those factors, along with three cheap stock recommendations, right now.

What makes it cheap?

Cheap stocks have to be fundamentally cheap. That means looking at the company’s fundamentals to decide whether they’re really cheap or not. What we really mean by this is the stock is undervalued.

Now, this is different from value stocks. Value stocks are usually blue-chip companies that also offer perks like dividends. Cheap stocks, however, may simply be far lower than they should be based on their future projections. And this comes down to a few valuations I like to look at.

First there’s the price-to-earnings ratio (P/E). The P/E ratio tells you how much an investor is will to pay per share compared to its earnings, and is cheap if under 15. Then there’s the relative strength index (RSI), which is cheap under 30 and puts it in oversold territory. I also look at debt, seeing how much equity the company has compared to its total debt. This should be below 100%, meaning less than 100% of its equity will cover all of its debts.

Then, of course, there’s the share price. If shares are down, then it’s a great time to find cheap stocks. That just so happens to be the case right now. So, let’s look at three cheap stocks I’d consider.

Three cheap stocks

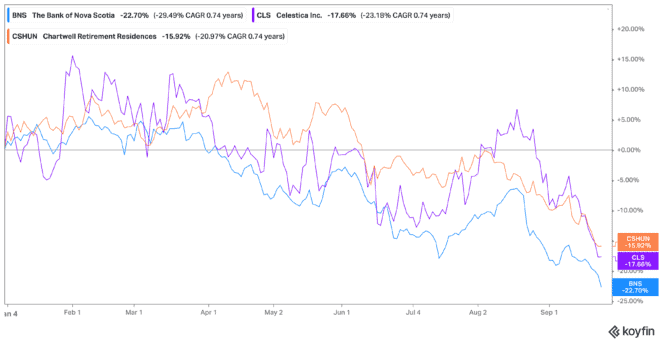

The three cheap stocks I would consider on the TSX today would be Chartwell Retirement Residences (TSX:CSH.UN), Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) and Celestica (TSX:CLS)(NYSE:CLS).

All three of these companies check most if not all these boxes. But there’s first one thing I want to focus on as well, and that’s the future sustained growth of these cheap stocks. Chartwell is in the long-term-care and retirement residence sector, where the Canadian population will continue to age, as the baby boomers need more care. Scotiabank is a Big Six bank, one that has come back to pre-fall prices within a year of its fall. Finally, Celestica provides supply-chain solutions — something we all desperately need to be solved.

So, let’s look at the fundamentals here. Chartwell stock trades with an RSI of 24.93. Its P/E ratio is soaring though at 476 as of writing. Still, it offers a 6.38% dividend yield that investors can look forward to.

Then there’s Celestica stock, which is even cheaper. Celestica stock has an RSI of 28.91. It trades with a P/E ratio of 8.69, and it would take 52.59% of its equity to cover all its debts. Shares are down 17% year to date, making it a great time to buy.

Finally, there’s Scotiabank stock, trading at 8.05 times earnings and with an RSI of 23.67. It has a 5.95% dividend yield, with shares down 23% year to date.

Bottom line

These cheap stocks all offer a sustainable way to create long-term growth, all for a cheap price. While they might not fall in value territory, each provides you with the fundamentals that mark them as a great buy. So, consider these cheap stocks for your watchlist today!