October is upon us, and the market continues to dive further down. While there was an increase in the TSX last week, it wasn’t much to get excited about. The Canadian stock index continues to trade down 8.5% year to date, an improvement from 13% last week. However, it remains down by 16.5% from peak prices to today so far in 2022. Yet healthcare stocks may be just the place to store your money and keep your portfolio healthy.

The healthcare sector saw a lot of movement during the last few years due to the COVID-19 pandemic. However, it’s important to separate strong stocks from market flukes.

That’s why today I’m looking at three healthcare companies investors should consider as the TSX continues to trade in value territory.

WELL stock

WELL Health Technologies (TSX:WELL) surged during the pandemic as the world over was told to stay home. The company provides technology to allow for virtual healthcare assistance. It’s one of the healthcare plays that soared as it aided patients with finding healthcare options.

However, once a vaccination was approved shares dropped. They dropped even further with the pushback on tech stocks. Yet WELL did nothing to deserve the punishment.

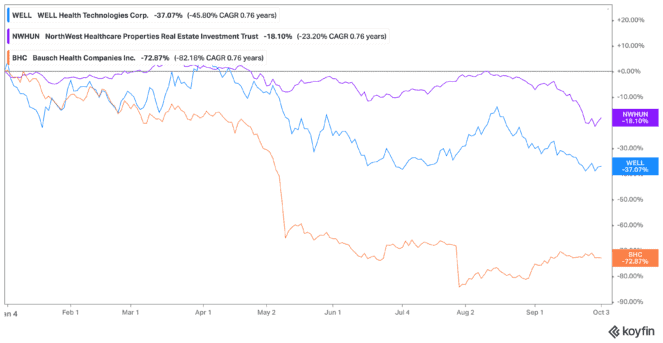

WELL Health continues to be the largest outpatient clinic in Canada. The company is expanding into the United States, and continues to post record earnings. In fact, it’s done so well it would only take 47.9% of its equity to cover all its debts. Even after shares dropped 37% year to date. Analysts believe the stock will more than double in the next year, so it’s one I’d at least watch for now, if not buy this October.

NorthWest REIT

Another healthcare pick I’d buy this month without a doubt is NorthWest Healthcare Properties REIT (TSX:NWH.UN). In fact, I already own Northwest stock, but am likely to buy more at these prices. NorthWest also saw a surge during the pandemic, but remained fairly stable only until recently with the second drop in shares on the TSX.

Yet again, it doesn’t deserve the drop. NorthWest stock continues to post record revenue as well thanks to its expanding healthcare properties around the world. The $2.6-billion healthcare stock is down 19% year to date, trading at 6.2 times earnings. This despite maintaining a 97% occupancy rate and average lease agreement of 14.1 years!

But with this downturn comes a great opportunity, the NorthWest stock dividend, now at a whopping 7.55%! You’re not going to see these prices for much longer, so if you need cash this is the stock I’d buy.

Bausch Health

Finally, Bausch Health Companies (TSX:BHC)(NYSE:BHC) falls into the middle ground. It’s seen volatility during the last few years, but analysts also believe there could be major growth in the years to come. This comes from the company ending disputes in court, and also breaking off its Bausch & Lomb arm to become its own company.

The stock has not done well this year, with shares down 72% year to date. But there is the chance it could explode in share price when we’re out of this downturn, with the companies both able to focus on its eyewear industry, as well as its medical device and over-the-counter products. But I won’t lie. This is definitely the riskier of the three healthcare industry stocks.

Bottom line on healthcare investing

There are plenty of healthcare companies out there offering a substantial opportunity. The pandemic isn’t over, but even with restrictions basically gone, these three have lots to look forward to. Whether it’s the stability of healthcare properties, the necessity of telehealth, or the emergence of growing products, all three healthcare picks give investors growth for their portfolio.