Just when we thought the floodgates were closed for good, the TSX continued its drop last week. Shares of the TSX are down 8.5% year-to-date, and 16.5% since 52-week highs. That still puts it in market correction territory.

However, there are some signs of hope. Last week, shares of the TSX were down by 13% year-to-date. So, there’s already been an increase of 4.5 percentage points. With that in mind, you may want to get in on this down market before it’s too late.

Why?

It’s a fair question. Here at the Motley Fool, we like to recommend long-term holding. This has been the proven path to overall riches time and again. Sure, we’d all like to be that one person who bought shares at $3 and watched them balloon to $3,000. But how realistic is that?

Not realistic at all. There are proven long-term methods for making gains that extend far beyond short-term growth stocks. For example, let’s say you invested in Amazon (NASDAQ:AMZN) when it was at around $0.37 per share (accounting for stock splits). You then sold a year later in 1999 at $4.30 per share. That’s a huge win of 1,061%!

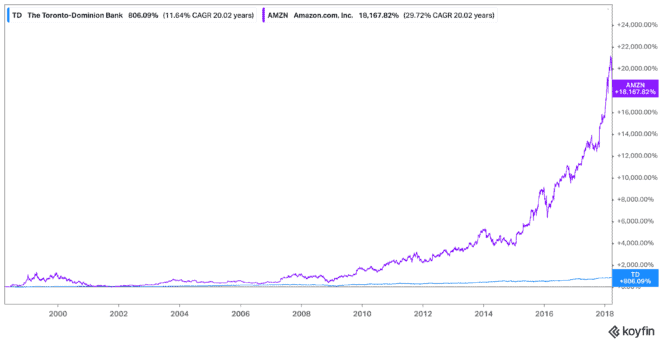

But consider if you had held out for decades. I’m sure you can see where I’m going with this. That would have resulted in gains of 18,167%! Enormous. But what’s more, you don’t have to find a stock like Amazon. You just have to find a safe stock and pick it up on the dip.

The math adds up

So instead of focusing on a riskier tech stock, let’s look at a safe choice like Toronto-Dominion Bank (TSX:TD)(NYSE:TD). TD stock is safe because it’s one of the Big Six Banks, and one of the largest by market capitalization. What’s more, it has a dividend you can reinvest, which growth stocks typically do not.

Similar to the Amazon example, let’s say you purchased shares back in 1998. Two decades later, you would have watched these shares bloom to 806%! While that isn’t the thousands of percentage points you get with a growth stock, it’s far less risky because you know the stock will bounce back.

Amazon stock has had a rough go for a few years, and it has yo-yoed several times. TD stock, meanwhile, has dipped during down markets only to rise again and soar past all-time highs. Right now, TD stock is down by 8.5% year-to-date. It trades at 10.97 times earnings and offers an attractive 4.2% dividend yield. Again, that’s cash you can use to reinvest in the stock down the line.

Bottom line

A down market is the perfect time to get in on long-term stocks you’ll want to hold forever. Despite its gains, I still consider Amazon somewhat risky given it’s in the e-commerce industry. That being said, it’s also proven to be a strong choice for long-term investors. Something other tech stocks cannot claim.

But if you want real safety, I would go with TD stock and the other Big Six Banks. They trade well below fair value, and you can collect dividends while you wait for a recovery. And with shares down to some of their lowest points this year, it’s a great time to buy for a rebound.