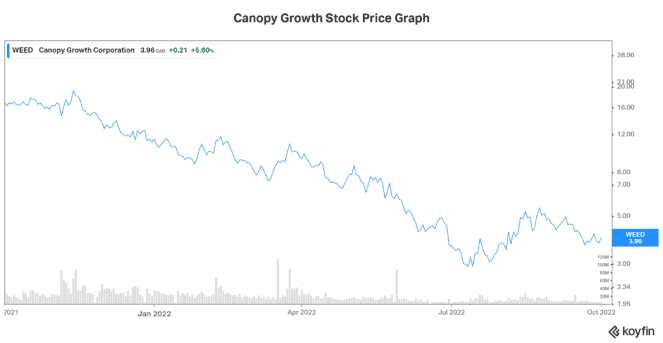

Whatever you might think about cannabis stocks, the fact remains that the cannabis market is massive. Yet, stocks like Canopy Growth Corp. (TSX:WEED)(NASDAQ:CGC) continued to get hammered in September. The once high hopes for this stock have been all but dashed. So, as it faces another month of sharp declines, let’s find out what happened in September. Why did Canopy Growth stock fall 23%?

Canopy Growth stock faces more losses

September saw an intensification of pressure on the economy and markets. Interest rate hikes continued – foretelling economic woes and company troubles. In turn, this has exasperated investors’ reluctance to own “risky” assets.

As this sentiment continued to dominate the psyche of investors, stocks like Canopy Growth were among the many losers. In fact, Canopy Growth’s stock price took one of the biggest hits. A difficult macro-economic environment is too much for a stock that’s dealing with its own company-specific turmoil.

Simply put, a rising interest rate environment doesn’t favour stocks like Canopy Growth. Hence, the stock continued to decline in September.

A focus on margins

It has been Canopy’s position that the company will focus on increasing margins. Their goal is to stop the bleeding and turn its business into a money-making machine. To this end, the company has taken some drastic measures.

Amid pricing pressure and rising costs related to its Canadian retail business, margins have been taking a hit. As a result, the company decided to divest of this segment. The divestiture includes the sale of stores operating under the Tweed and Tokyo Smokes retail banners. With gross margins at roughly 15%, there was little room for error in this rapidly deteriorating business.

So, with this divestiture, Canopy Growth is setting itself up for a better tomorrow. The fact that Canopy is selling these businesses at a much lower price than what they bought them for is unfortunate, but irrelevant at this point. The stock price surely factors in the fact that these acquisitions have resulted in significant value destruction. These errors were made by the previous management teams – and they’re in the past.

Out with the old, in with the new – the way forward for Canopy Growth

Through all of this, I see a silver lining. I like the fact that management is taking action to improve margins. In fact, the company is making business decisions in a thoughtful and strategic manner. This is unlike the Canopy Growth of the past, when acquisitions were being made at the height of bubble valuations.

Canopy Growth is now dedicated to being a premium brand-focused cannabis and consumer-packaged goods company. Clearly, the risk profile has been lowered, and I can now wrap my head around Canopy Growth stock. While it’s still in high-risk territory, there are real signs of strength. For starters, the divestiture is a step in the right direction on the road to profitability.

Also, Canopy’s entry into the sports drink market has been a success. Canopy’s brand, BioSteel, sells sports hydration drink products. It’s currently seeing record sales, with increasing shelf space from the likes of Walmart. Additionally, Canopy is revamping its own beverage portfolio, as strong demand continues for its beverages like Tweed Iced Tea.

Motley Fool: the bottom line

In closing, Canopy Growth’s stock price fell sharply in September as the cannabis industry continues to suffer growing pains. But the company is executing on its strategy to overcome these conditions. Despite very bad sentiment and elevated risk, my view is that Canopy Growth stock is in a better position than ever.