October started off strong for investors, with the TSX seeing an improvement already this month after a sharp downturn in September. While it may not last long, there are a few sectors I remain bullish on for the foreseeable future.

And I do mean the future. After all, if you’re going to get into investing it should be for the long term, not short. So there are still deals to be had during this downturn, but with some hope on the horizon, the TSX sector I’d get in on now is renewable energy.

Why renewable energy

Renewable energy provides investors with a path to insane growth in the decades to come. Think about the oil tycoons and coal companies of the past. That’s where we’re at right now. Of course, the problem is that you have to choose the right companies if you’re going to invest in renewable stocks.

Luckily, you don’t necessarily have to invest in just one company providing one type of energy project. Instead, you can invest in a company that has a bunch under its banner, as well as a strong backer.

That company is Brookfield Renewable Partners LP (TSX:BEP.UN)(NYSE:BEP).

Brookfield’s growth

There’s a reason I’d choose Brookfield Renewable stock over other renewable energy stocks right now. The main reason is its diversification. The company has practically every type of renewable asset under its banner, but is also diversified in its locations as well.

Investing in Brookfield gives you access to offshore wind farms, hydro plants, and solar farms. You can gain access to deals being made in a Europe seeking to get away from Russian oil, but also to future growth from deals in the United States as well.

Furthermore, there is a solid history of growth here. This is not a new company with startup growing pains. Quite the contrary, it’s been around for decades, and has backing by parent company Brookfield Asset Management.

How much growth are we talking?

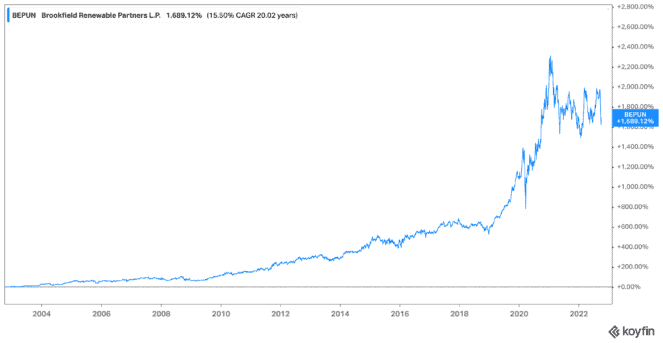

If you want to see just how much growth there could be in the decades to come, let’s look at the past first. Brookfield Renewable stock has seen shares rise by 1,692% in the last two decades alone. That’s a compound annual growth rate (CAGR) of 15.5%, and includes the recent pullback.

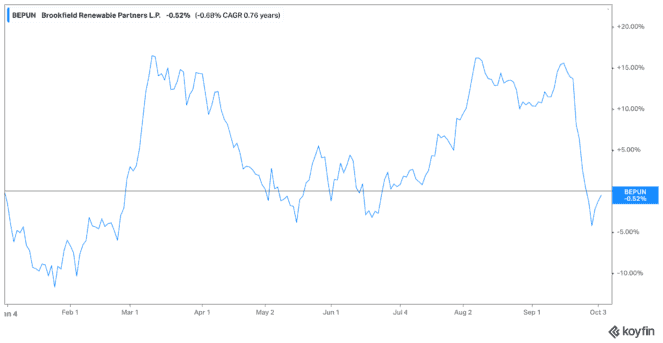

It was one of the last stocks to finally fall into negative territory last month, with shares down 4.3% year to date. But there’s already been improvements this month, with shares now back where they were at the start of 2022.

Why does this matter? Because we could see a resurgence of this stock back to 52-week highs even this month! Other growth stocks have seen major movement, but Brookfield is a growth stock that has the stability to make investors stay. Part of that comes from its dividend yield, currently at 4%, which investors haven’t seen for quite some time.

The future is calling

This October, I would sincerely consider investing in Brookfield Renewable stock while it’s still down. Shares could reverse at any time, thanks to long-term contracts that bring in stable revenue. Something investors will want should we enter a recession in 2023.

Meanwhile, you can bring in a 4% dividend yield as of writing, all while catching shares at prices we haven’t seen since February. So, let me give you a glance at what you could be looking at over the next few months and years.

Should Brookfield hit 52-week highs, a $10,000 investment today could be worth $12,045 in the next few months alone! And if it keeps growing at a similar CAGR, in the next decade you could see that $10,000 turn into $56,503!