The TSX Index has declined almost 10% in 2022. Yet, many TSX stocks are down by many multiples of that decline. Basically, if you bought any stock early this year, you’re likely to be in the red.

Certainly, bear markets can be incredibly uncomfortable. It always feels like “this time it’s different” and the market will never recover. Yet, time and time again it does. The question most investors need to ask themselves during these times is, “am I a speculator or an investor?”

Are you a speculator or an investor in TSX stocks?

Speculators watch stock prices and use them to determine when to buy and sell. They seek to understand the macro-economy to time their positions in and out of the market. It can be a dangerous and unpredictable game.

Investors, on the other hand, watch the businesses that the stock belongs to. They invest in a business because it has great products/services, smart managers, opportunities to grow, and competitive advantages.

Investors buy stocks when the market declines because they can take advantage of an entry point that’s at a lower valuation than the real business value. Investors buy for the long-term because they can envision the business growing by many multiples from the size that it operates at today.

A long-term mindset can help you beat the TSX

If you want to avoid the perils of a bear market and outperform over the long-term, you need to think like an investor. This means less timing and more time in the market. It means patience and emotional control.

Some of the greatest investors, like Warren Buffett, have created massive wealth by taking this long-term approach. If you’re looking for some TSX stocks with market beating potential, Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) and Canadian National Railway (TSX:CNR)(NYSE:CNI) are two to add to your watchlist.

A top Canadian financial stock

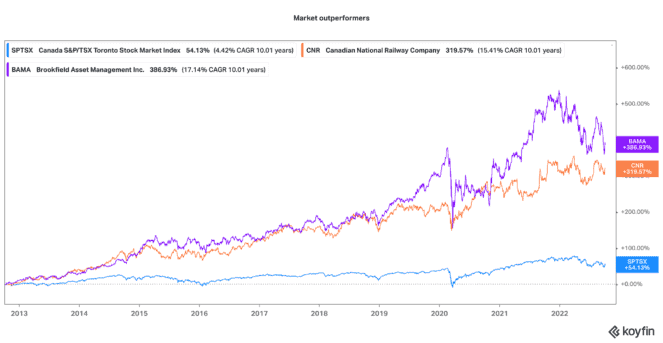

Brookfield Asset Management is an ideal stock to hold as an anchor in your portfolio. For the past 10 years, it has beat the TSX Index by over 330 percentage points.

BAM manages alternative assets which includes everything from real estate to renewables to insurance. It earns management fees and carries interest from a diversified set of assets, which helps to offset volatility in its business.

It has grown assets under management (AUM) by a compound annual growth rate (CAGR) of 32% since 2002. Likewise, distributable earnings have increased by 1,200% in that time.

Given its strong balance sheet, solid track record of capital deployment, and significant opportunity to more than double its AUM, Brookfield expects the next five years to be even better than the past five years. This stock is cheap today and should outperform the TSX for many years to come.

A top TSX transportation stock

If you’re looking for a blue-chip stock with an outstanding record of returns, Canadian National Railway should be on your short-list. For the past decade, it has outperformed the TSX Index by 266 percentage points.

This is an optimal stock to hold through a recession. Railway companies have some of the widest moats out there, meaning their shares don’t tend to lead to downside at the first signs of a recession. They also tend to be among the first to recover when the economy re-expands. CN has an incredible transportation network across Canada and America. Its assets are simply irreplaceable and crucial for the North American economy. Plus, the company has a new CEO focused on maximizing volume and profitability through its network.

Despite the bear market, CN stock has held up exceptionally well (neutral on the year). The stock is in a strong position to weather short-term macro conditions considering its recent quarterly beat of $1.93 earnings-per-share (EPS) versus the $1.75 consensus target. It pays a 1.9% dividend, and it has a decades-long track record of growing that dividend. For income and growth, CN is the perfect staple stock that’s staged to outperform the TSX Index for years ahead.