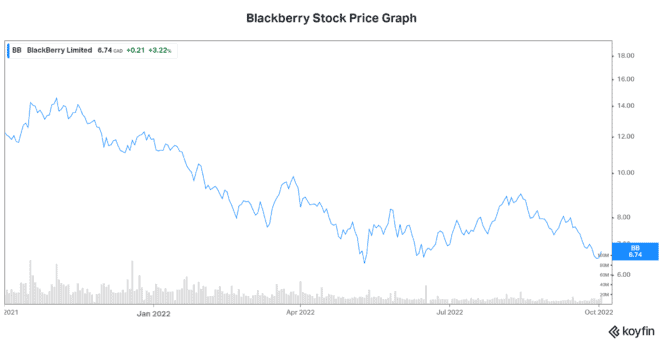

Let’s face it, September was a rough month. With the TSX falling 4.6%, all stocks were fighting a losing tape. Blackberry Ltd. (TSX:BB)(NYSE:BB) stock was no different. In fact, as usual, it was more volatile than most. At the end of the day, Blackberry stock fell 16.5% in September as the markets fell victim to an increasingly unfavourable macroeconomic environment.

Rising rates are not good for anyone, especially the higher risk companies with a lot of potential but no earnings – like Blackberry.

Blackberry stock (BB) reels as investors grow impatient waiting for growth

At the end of September, Blackberry reported its second quarter, fiscal 2023 results. They were not what we would have hoped for. In fact, its net loss of $0.05 per share reminded us that Blackberry still has a long way to go to become what we think it can become. But the CEO did offer glimmers of hope on the conference call.

For example, billings in Blackberry’s cybersecurity business were promising. The market is dominated by Microsoft, but feedback from customers is encouraging. Apparently, Blackberry’s level of security protection is unmatched, even by the likes of Microsoft.

Moving on to Blackberry’s embedded systems (Internet of Things) segment. This is where the massive potential is. This segment currently accounts for 30% of Blackberry’s total revenue – and it’s where the real growth is expected. In the quarter, revenue increased 28% as demand was strong.

The bottom line here is that the headline numbers are still dismal for Blackberry. Its latest quarter is further evidence of this. This is what has dragged down Blackberry’s stock price once again in September.

Yet, if we dig a little deeper, I think we will come out of this feeling much more bullish.

Analysts reduce their ratings and target prices on Blackberry stock

Visibility – it’s what we like to see in a company that we invest in. But sometimes, there’s little visibility. And sometimes, we can only have faith and conviction in our investment thesis. This is the case for Blackberry. Markets are uncertain and we have limited visibility into Blackberry’s future. This combination does not bode well for predictability and confidence.

So it’s not surprising that analysts have been reducing their target prices and ratings on Blackberry stock in September. For example, RBC lowered its target price for Blackberry to $6.00 from $6.50. Likewise, Canaccord Genuity lowered its target price to $5.00 from $6.00.

While these moves are understandable given the price action in the market today, it feels sort of backward-looking and reactionary to me. Because in reality, Blackberry is closer to success than it has ever been. For example, IVY, which is Blackberry’s partnership with Amazon Web Services, is seeing strong demand. The pilots are going well and Blackberry hopes that it will be in production by the end of the year. This software is changing cars as we know them, introducing different apps and safety features into our driving experience.

Factoring in ultra low expectations

Sentiment in the market in general deteriorated in September. Negative sentiment had already taken hold of Blackberry stock, and this just intensified the downward pressure. But the one thing that speaks volumes to me is the fact that Blackberry’s second quarter results, bad as they were, came in above expectations. This implies that the expectations built into Blackberry stock (valuation) are not high enough.

While there were plenty of reasons for Blackberry’s stock price (BB) to be down in September, there are also plenty of reasons to believe that things will turn around in October and beyond.