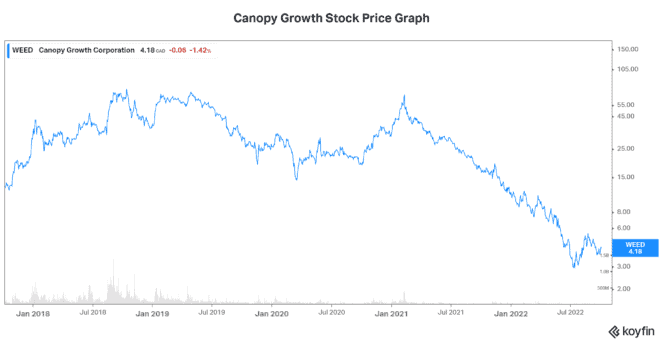

Canopy Growth (TSX:WEED) stock has become synonymous with volatility and uncertainty. Understandably, it’s hard to know what to make of the once high-flying Canopy Growth stock that got caught up in bubble frenzy not too long ago.

But let’s regroup and take a look at WEED stock again, because much has changed. Here are five things that we should know.

WEED stock aggressively chases profitability

In the heart of the cannabis bubble, WEED stock was rewarded for just about anything. When it overpaid for an acquisition, the stock rose. Likewise, when it expanded production capacity without the demand, the stock rose. The growth for the sake of growth without any care for profits or margins attitude was given a green light by investors who were pumping up the stock to ridiculous heights.

Today, things are different. Thankfully, Canopy Growth stock is also different — with new management and new goals. A greater focus on select geographies and select segments has resulted in a sharp decline in spending. For example, capital expenditures are down sharply, as the company has honed in on its focus.

In fiscal 2020, WEED served 15 markets with 11 facilities. In 2022, it serves three core markets with four facilities. Capex has declined to $20 million in 2022 from $212 million in 2020. Also, selling, general, and administrative expenses have declined to 68% of sales from 135% of sales. Importantly, revenue in 2020 was $398.8 million versus $520.3 million in 2022 — for a 30% growth rate over this time.

This new focus is key for investors to know. Back in the bubble days, this type of discipline and thought process was not on the table for WEED. Today, we see a real business attempting to come out from the ashes.

Focusing on consumer goods products like BioSteel

Canopy Growth’s focus is on being a premium brand-focused cannabis company and a consumer packaged goods company. To this end, many new products have been launched in 2022 — 50 in just the first half of the year. Examples of these products includes Tweed FIZZ, a cannabis-infused sparkling water, and Tweed Iced Cannabis Tea.

BioSteel is another highlight of Canopy’s business. This sports hydration drink’s revenue is growing at 180%. With deals to sell at prime retailers such as Walmart, we can expect this strong revenue growth to continue. Also, BioSteel is the official sports drink for the NHL and for the Los Angeles Lakers.

Prime position with a strong balance sheet

From drinks to creams to sleep aids, the market for cannabis-infused products is huge. Thankfully, Canopy is in a good position to capitalize on these opportunities. Currently armed with $1.2 billion in cash, WEED can happily pursue its goals in the coming months. Last quarter, Canopy burned through just over $140 million in its operations.

Canopy is preparing for U.S. legalization

CBD and THC are both found in cannabis plants. They are similar in structure. But the main difference is that THC will give the user that famous high or euphoric feeling, while CBD will not. Right now, none of this is legal on a federal level in the United States. However, many states have already legalized or are in the process of legalizing it. Many believe that the federal government is not far behind. It’s estimated that the U.S. market will be worth more than $21 billion in 2023.

With this being said, it’s clear that Canopy Growth is going after the U.S. market and is waiting to pounce. Right now, the U.S. accounts for 15% of Canopy’s total sales (up 91% versus last year). Its partnerships and distributor relationships through Constellation has given Canopy a network that will allow fast access and penetration.

Fallen multiples and low estimates

For those of you who remember the cannabis bubble days, you will recall that Canopy Growth stock was trading at north of 100 times sales. Today, it’s trading at 3.7 times sales. More importantly, there’s more reason than ever to believe that Canopy will in fact be successful due to its size and scale. Ultimately, with its new focus on margins and profitability, I think WEED can and will profit very significantly from its first-mover advantage into the cannabis industry.