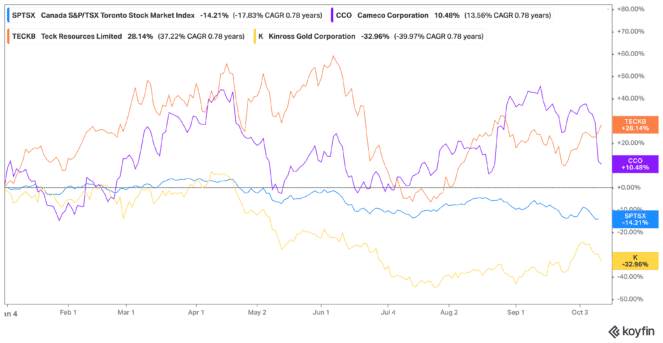

Canadians continue to trade in this poor economy, but have started taking out more and more cash. How can we tell? Because the TSX is now down past 52-week lows, and about 14% year to date as of writing. Yet some metals stocks have continued to grow in value.

Today, I’m going to go over three of these top metals stocks and see what exactly they’ve been up to that makes them so special in this market.

Cameco

Cameco (TSX:CCO)(NYSE:CCJ) would definitely be considered special in this market, as it’s in a prime position for growth. Even as the TSX drops, Cameco is one of the metals stocks that remains in high demand. That’s because it’s one of the largest miners of uranium in the world, a metal needed for the transition to clean energy.

That’s especially true now. Sanctions against Russia after the invasion of Ukraine has led to even less uranium in the market. With reactors being built across the world, Cameco stock has to step up its game. And that’s led to a soaring share price, even during this downturn.

Cameco stock did drop recently, but is still up 10% in the last three months. So it could be a great time to jump on it along with these other metals stocks.

Teck Resources

Another stock seeing a climb is Teck Resources (TSX:TECK.B)(NYSE:TECK) and that’s because it’s a necessity. Yet unlike Cameco stock, it doesn’t focus just on one product, but many. Whether it’s gold and silver, copper or steel-making coal, it produces it all. That’s allowed it to continue growing even during this bear market.

These kinds of metals stocks are Warren Buffett favourites because they actually produce something. So Teck stock isn’t likely to simply flip back after all this growth. Shares are now up 35% in the last three months alone, and could continue to rise higher for the foreseeable future.

With so many stocks trading down, including metals stocks, Teck stock is one I would buy at any price and hold onto. But especially with a 1.14% dividend yield, a 4.48 price-to-earnings ratio, and needing only 34.88% of equity to cover all its debts.

Kinross

Kinross Gold (TSX:K)(NYSE:KGC) didn’t have the best year until recently, and shares are actually still down year to date. However, in the last three months there’s been a rebound in the gold stock. It’s now one of the metals stocks I would consider buying, or at least adding to your watchlist.

Shares of Kinross stock are now up 15% in the last three months. So why the flip? There were a few catalysts but perhaps the biggest was a share buyback program, whereby the company announced it would purchase US$300 million in shares in 2023 through 2024.

With that in mind, the company must be looking forward to even more growth in the future. And that future already looks brighter next year, making it a great time to buy the stock. Especially as it’s one of the metals stocks down 33% year to date, despite the growth in the last three months.

Bottom line

Whether you’re looking for growth in the next year, decade, or for life, these three metals stocks give you strong options. Each is still reflecting value on the TSX in this bear market, but have shown immense growth in the past three months. So buy them now before you miss out.