All manner of investment risks have emerged in 2022. Market watchers calling out a global economic recession on the horizon keep shaking investor confidence. However, Canadian defensive stocks have proven their mettle so far this year. Notably, Loblaw Companies (TSX:L) stock has proudly outperformed peers to make it one of the best consumer staples stocks to hold in 2022. Actually, I’d have made some good money if I’d invested in Loblaws stock and held it through the market turbulence

Despite a 7% drop in Loblaws stock price during the past month, the shares retain a respectable 5.6% year-to-date (YTD) gain. Resultantly, L stock has widely beaten the S&P/TSX Composite Index, which is down 15% so far this year. It had even outperformed peers on the S&P/TSX Capped Consumer Staples Index, which has largely been flat so far this year.

Why has Loblaws stock outperformed the TSX?

Loblaws stock has widely outperformed the broader Canadian stock market because it is viewed as a defensive stock. The consumer business usually thrives during periods of high inflation, and may continue to grow during recessions. Canadian consumer staples have been the best place to be so far in a tumultuous 2022.

The company is Canada’s largest retail store operator and runs a growing pharmacy chain – Shoppers Drug Mart. Food and drugs are life essentials. As a consumer staples company, Loblaws serves a stable customer base that remains largely loyal, even during tough economic times.

The business’ defensive qualities remained intact during the first six months of 2022. Revenue increased by 3% year over year during the first half of the year. And the retailer reported an impressive 8% growth in operating income for the period. Actually, Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation, and amortization) margins expanded during the period as drug retail margins grew.

Loblaws’ operating excellence is augmented by a shareholder-friendly capital budgeting policies. During the first six months of this year, Loblaw Companies spent $728 million repurchasing its own stock on the open market, up from $700 million during the first half of 2021. Share repurchases support stock price strength and reduce claims on Loblaw’s future earnings and dividends.

And speaking of dividends, management keeps increasing the company’s quarterly dividends at double-digit rates. The September dividend paid out for the second quarter of 2022 was 11% higher than a similar payout in 2021.

If I’d invested in Loblaws stock, how much would I have now?

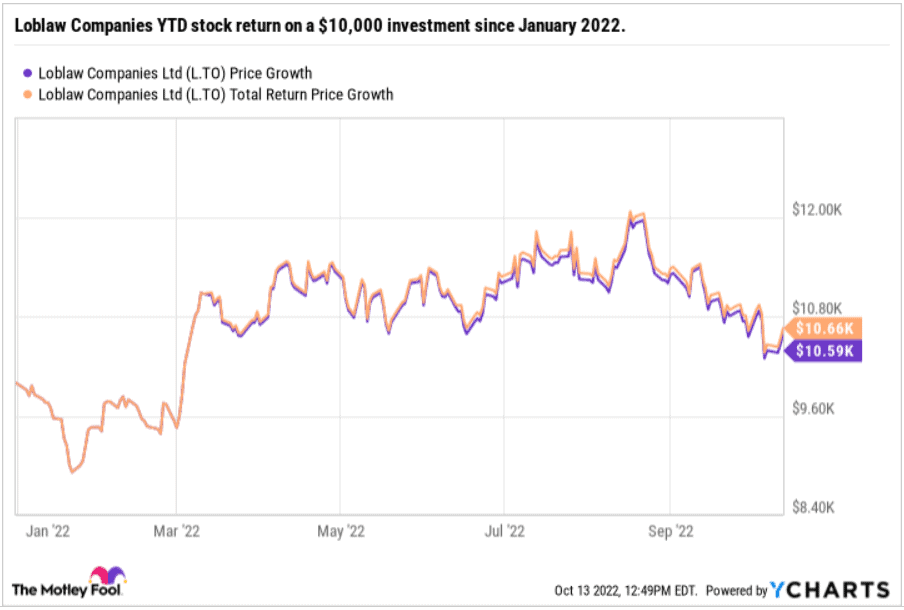

Investors who bought Loblaws stock at the start of 2022 have not only preserved their capital, they have enjoyed capital appreciation and received regular dividend income thrice so far this year. A $10,000 position in L stock is worth more than $10,580 today. Including dividend reinvestment, an investor would have grown the position to more than $10,600 by now.

Is Loblaws stock a buy right now?

Stock prices may remain under pressure as interest rates rise and investors incorporate higher discount rates into their valuation models. Loblaws stock may not be that immune as investor sentiment weakens.

That said, the company is currently generating positive free cash flows, and may take advantage of any weaknesses in its stock price to repurchase more shares, and boost the remaining shareholders’ interest in the business, supporting higher share prices.

Most noteworthy, consumer staples are defensive stocks that can offer steady growth and relative capital protection during stressful times. Undoubtedly, 2022 is the year when such a portfolio shelter is required, and necessary.

Although past performance is not a predictor of future returns, $10,000 invested in Loblaws stock in January 2010 would have grown to more than $49,700 today. Dividend investors may view the current dividend yield of 1.5% as negligible. However, without the Loblaw dividend, total account growth could have been limited and value capped under $38,300.

Loblaws stock may make up part of any core portfolio. Its low-yielding (but growing) dividend is still important, and share repurchases will support capital appreciation over the long term.