If you’re a bit late to the investment game, don’t worry. Assuming you’re planning on retiring at 65 like most Canadians, you still have a runway of 25 years to work with. By making consistent contributions, selecting diversified investments and staying the course, you could still create a six-figure portfolio.

Today, I have some great advice and strategies for middle-aged investors from the “Oracle of Omaha,” Warren Buffett, himself. Buffett is one of the most successful value investors in history, having made his fortune buying the stocks of downtrodden large-cap U.S. companies.

Despite being a successful stock picker, Buffett is actually a fan of index investing and suggests a simple, but highly effective strategy using exchange-traded funds (ETFs) for the average retail investor. Want to know his method? Keep reading to find out.

The Warren Buffett strategy

In 2013, Buffett penned a letter to Berkshire Hathaway shareholders where he explained his rationale for how he wanted his estate to be invested upon his passing. Now, most people would think that Buffett might have left some key stock picks, but the opposite is true.

Instead, Buffett instructed his trustee to invest 90% of his estate in a low-cost S&P 500 Index fund, and the other 10% in short-term U.S. treasury bonds. This portfolio has since become known as the “Buffett 90/10,” and it turned out to be a highly effective strategy for long-term investors.

Canadians can implement this in their Registered Retirement Savings Plan using U.S.-listed ETFs to save on the 15% foreign withholding tax on dividends. The best funds to use here in my opinion are Vanguard S&P 500 Index ETF (NYSEMKT:VOO) and Vanguard Short-Term Treasury Index Fund ETF (NASDAQ:VGSH).

Both of these ETFs are extremely cheap, with expense ratios ranging from 0.03% to 0.04%. For a $10,000 investment, this means around $3-$4 in annual fees. To create this portfolio, simply buy 90% VOO and 10% VGSH and re-balance them annually. Hold for 25 years and reap the results!

Historical performance

Note: the backtest results provided below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

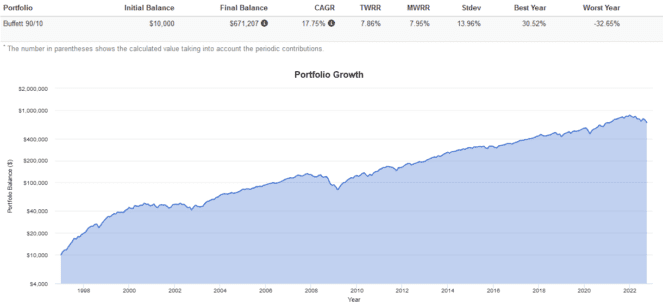

Let’s assume you started investing in 1997 as a 40-year-old with just $10,000 to start your portfolio with. You put it into a 90/10 mix of VOO and VGSH and stuck to contributing $500 monthly (or $6,000 annually as per the Tax-Free Savings Account contribution limits) and held for 25 years until 2022.

Despite losses during the 2000 Dot-Com Bubble, the 2008 Great Financial Crisis, the 2020 Covid-19 Crash, and the 2022 Bear Market, sticking to this strategy would have turned your initial $10,000 investment into a cool $671,207, which is more than enough for a comfortable retirement.

All you did was hold two low-cost index ETFs for 25 years, consistently contribute $500 a month, and stayed the course, which meant not timing the market or panic-selling. Buffett’s strategy hinges on keeping fees low, diversification high, and good investment behaviours. Consider giving it a try!