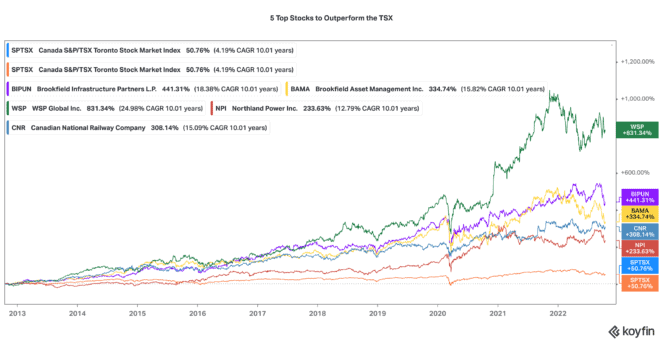

Whether you like it or not, bear markets are the best time to buy stocks. It may feel like the worst time to invest, because the world appears to be falling apart. Yet stock prices have fallen significantly, and valuations are becoming very attractive.

If you have five years or more to invest, here are five stocks that have a high probability of delivering market-beating returns ahead.

Brookfield Infrastructure stock

Brookfield Infrastructure Partners (TSX:BIP.UN) stock just fell 18% over the past month. Trading for 11 times funds from operation (FFO) per share, BIP stock has not been this cheap since early 2019 (other than the March 2020 market crash).

Despite that, BIP is operating on all cylinders. Its diverse mix of utilities, ports, pipelines, data centres, and cellular towers are benefitting from elevated inflation. Last quarter, its FFO grew 30%!

BIP stock trades with a 4.3% dividend yield, and it has a great record of growing that dividend. For a low-risk stock that can compound total returns by a mid-teens growth rate, BIP is one of the best.

Brookfield Asset Management

Speaking of Brookfield, Brookfield Asset Management (TSX:BAM.A) looks to be an excellent bargain today as well. Its stock is down 39.4% this year. With a price of $54, BAM stock is trading at a near 50% discount to its intrinsic value.

Brookfield manages over $750 billion of alternative assets (everything from real estate to insurance). The company has a lot of investable cash, so the current recession could present ample opportunities to invest in or acquire cheap businesses.

BAM is planning to spin off 25% of its asset-management business late this year. Several analysts believe this could unlock a lot of value for shareholders. If you have a long investment horizon, this is a solid TSX stock to pick up now.

CN Rail

For its combination of growth and income, Canadian National Railway (TSX:CNR) is a good anchor stock for any Canadian portfolio. It operates an economically crucial transport network. It has a strong competitive moat and great pricing power.

CN has compounded stock returns by an average of 13% annually for the past decade. It has a new chief executive officer focused on excellence and efficiencies. That could help drive even better results ahead.

CN has grown its annual dividend rate by around 14% a year. Right now, this stock yields a dividend close to 2%. It’s not the cheapest railroad, but it is a very a high-quality business you will be glad to own for decades ahead.

Northland Power

Northland Power (TSX:NPI) is a great stock for a combination of defence and growth. It has a diversified business of utilities and renewable power assets across North America and Europe.

Northland is a leader in offshore wind developments. This is one of the fastest segments of growth in the renewable power sector. Given the global energy crisis, it is benefiting from strong power pricing and a fast-growing backlog of development projects.

After a recent 13% price drop, this stock looks very attractive below $40. Not to forget, it also pays a nice 3.2% dividend.

WSP Global stock

WSP Global (TSX:WSP) has averaged a 20% average annual total return since 2014. Over the years, it has grown into a leading consulting, engineering, and design firm around the world. The company has a great track record of making smart acquisitions that expand its capacity, service coverage, and/or expertise.

It has an aggressive three-year growth plan that is targeting strong organic and acquisition growth ahead. It is uniquely positioned in the environmental space, which clearly has ample opportunities for growth ahead. Its stock is down 18% this year and now may be a perfect time to pick up this high-quality business at a slight discount.