Well Health Technologies (TSX:WELL) is an omni-channel digital health company. It offers digital healthcare solutions for medical clinics and health practitioners globally. It’s also Canada’s largest outpatient medical clinic owner/operator and leading telehealth service provider. And it’s growing fast.

Let’s discuss why everyone is talking about Well Health Technologies stock, and why this interest comes as no surprise.

Well Health addresses a real problem with real solutions

Healthcare systems are notoriously lacking in technology. Every clinic operates on an island by itself, and there’s no sharing of records. Patients and doctors are stuck in the old way of doing things, and this has detrimental effects on both patient care and on the business. Most of us have felt the effects of this. Thus, we can clearly see the benefits of bringing technology into healthcare settings.

Well Health offers solutions such as digital Electronic Medical Records (EMR) Software as a Service, practice management software, billing and revenue cycle management solutions, and patient engagement technologies. These are solutions that both improve the management and efficiency of healthcare clinics and that offer real hope for improving patient outcomes.

Imagine your doctor has access to a system that stores and analyses all of your medical information. This could result in customizing healthcare decisions, treatments, practices, and products to suit individual patient needs. This is only possible with information databases.

The value of Well Health’s technology is clear. And this value is being recognized by the medical community. As evidence of this, we need only look at Well Health’s performance. Since its initial public offering in 2016, it has grown to $302 million in revenue in 2021. Since 2018, revenues have grown almost 3,000%. That’s a solid performance for a company whose time has come — healthcare is leaping into the new age of technology.

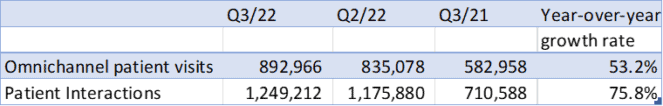

More recently, Well Health’s revenue growth has continued to be strong. In the first six months of 2022, revenue increased more than 200%. Also, the company has signaled that the strong revenue growth has continued in Q3. As we can see in the chart below, omnichannel patient visits and patient interactions were up significantly in the quarter, foretelling another strong revenue performance from Well Health.

Positive cash flows with strong revenue growth

Revenue growth is really great, but adding cash flow strength on top of that is much better. Well Health has a solid track record of cash flow generation. And this sets it apart from other companies that are starting out in a new and promising industry. I mean, it doesn’t take much for a company to run out of cash flow when they’re burning through it every year.

So, in its latest quarter, Well Health generated $33 million in operating cash flow. This was a 450% increase versus last year and a more than 150% increase versus last quarter. This is something to talk about. It appeals to investors — and rightly so. It makes this rapidly growing company less risky.

Yet Well Health’s stock price has been crushed by an uncertain and fearful market. But what may have hurt many shareholders also provides an opportunity to buy at ridiculously low prices. The graph of Well Health’s stock price below illustrates this.

Well Health Technologies stock has a long runway ahead, as the digitization of the healthcare system has only begun

Well Health’s strategy is to continue to acquire in order to consolidate this fragmented industry. Just last week, Well Health made yet another acquisition that will further strengthen the company’s position. It was a small $5.7 million acquisition of CloudMD’s billing and clinical assets. This strategy of small acquisitions has allowed Well Health to grow while extracting synergies and, ultimately, higher margins.

A report by Facts and Factors has estimated that the digital health market will hit over US$220 billion by 2026. This technological disruption in the healthcare sector has just begun. Before it’s over, it promises to detect disease earlier, treat it better, and lower costs dramatically. It’s no wonder people can’t stop talking about it.