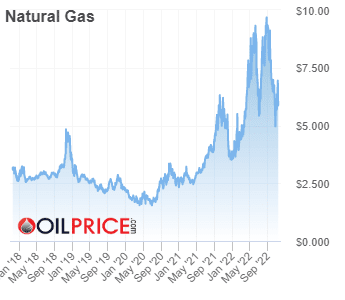

The cold, hard truth is that 2022 has been a rough year for many TSX stocks. In fact, this has been the year where many once-untouchable stocks have fallen significantly. But despite this, the fact is that there’s almost always a sector where we can find growth and solid returns. Today, energy is this sector.

Nuvista Energy (TSX:NVA) is a little-known Canadian natural gas company. Nuvista Energy’s stock price has returned 21% in the last three months, beating the TSX Index, which fell 1.6% during this time. This outperformance is huge, but can you still buy it after this spectacular run-up? Let’s find out.

Nuvista reports strong third-quarter results

A 60% natural gas weighting and a strong presence in the prolific Montney region have catapulted Nuvista to new highs not seen in many years. In fact, production is booming, along with cash flows and earnings. For example, in the third quarter, production rose 35% versus the prior year. Also, adjusted funds flow increased over 200% and earnings per share rose 52%.

This, of course, was driven by higher oil and gas prices as well as higher production. For example, Nuvista’s realized selling price for its natural gas was up 70%. Its oil sold for 31% higher, and its natural gas liquids sold for 33% higher.

I wasn’t kidding when I said that the energy sector is the one where we can find growth and strong returns.

Returning capital to shareholders

In response to this strong performance, Nuvista announced an increased return of capital to shareholders. What this means for now is that the company is stepping up share repurchases. It’s also accelerating its debt-repayment schedule. Management’s target net debt to cash flow multiple is one times. It’s based on a commodity environment where oil trades at $45 per barrel and natural gas trades at $2 per million British thermal units. These are the prices last seen a few years ago in the depths of the oil and gas downturn.

Upon the achievement of this target, Nuvista will return 75% of its cash flow to shareholders in the form of share repurchases. This can and will change with the changing stock price. But, as of now, this seems to be the best option, as Nuvista Energy’s stock price on the TSX trades at a mere 4.6 times cash flow and 1.9 times book value, despite soaring margins and return on equity.

Nuvista benefits from its top-quality assets

The high-quality inventory that Nuvista boasts is driving steadily rising production. The development of this inventory is low risk and high value. And it supports more than 30 years of development. This is driving increased profitability, efficiencies, and, ultimately, returns.

Another driving force for Nuvista’s stock price now and into the future is its natural gas exposure. The company has taken steps to diversify its exposure to different Canadian and U.S. markets. These markets can have surprisingly different natural gas prices. So, this diversification is essential to ensure optimal performance over time.

Also, with a 60% weighting, Nuvista’s exposure to natural gas allows the company to benefit from soaring global demand for Canadian natural gas. The Canadian market is rapidly opening to the globe, as Asian and even European countries look to Canada for natural gas. Their goals are clear: they want to replace coal with natural gas, which is much cleaner. Canadian natural gas is the best option, as it’s relatively abundant, clean, cheap, and reliable.

Motley Fool: The bottom line

In my view, Nuvista Energy’s stock price has plenty of upside left. Natural gas fundamentals are particularly strong, and I expect them to remain so for the foreseeable future. Nuvista is a relatively low-risk way to gain exposure. Thus, investors have plenty of time to get in and enjoy the continued upside.