Young investors, especially those with modest account, tend to underestimate the power of compounding and time. Most prefer to chase speculative “lottery tickets” — cryptocurrency, meme stocks, and penny stocks, which can lead to explosive growth but, more often than not, results in big losses.

At the Fool, we endorse a different investing philosophy, which consists of picking high-quality stocks, staying the course, and maintaining a long-term perspective. Let’s take a look at how we can put this into play using some examples from history.

How do I invest?

Picking stocks is hard. Picking high-quality stocks is even harder. A great way to instantly select a portfolio of decent stocks is via an exchange-traded fund that tracks a stock market index, like the S&P 500.

I like the S&P 500 because it represents some of the best publicly traded companies in the United States. It has returned around 10% annualized since 1957 and is very difficult for even professional investors to beat.

Investing in the S&P 500 these days is as simple as buying a Canadian-listed ETF that holds all of the companies in the S&P 500 at their correct weights.

My favourite ETF here is Vanguard S&P 500 Index ETF (TSX:VFV). It costs a management expense ratio of 0.09%, or $9 in annual fees, for a $10,000 investment, which is extremely cheap.

How can the S&P 500 make me a millionaire?

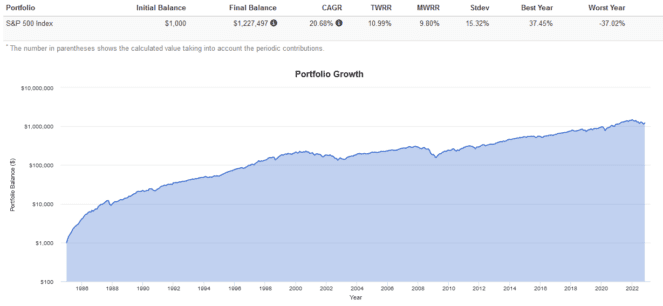

Imagine you started investing back in 1985 as a 20-year-old with just $1,000. You put it all in the S&P 500. Every month after for the rest of your life, you diligently invest $200.

Throughout this 37-year period, you kept up your $200 monthly contributions. You also never panic-sold, despite the 1987 Black Monday crash, the 2000 Dot-Com Bubble, and the 2008 Great Financial crisis.

37 years later in 2022, at age 57, you would have turned that $1,000 plus monthly $200 contributions into $1,227,497 by doing nothing more than invest in the S&P 500.

If you increase your savings rate, your total return would have increased exponentially. That’s the time value of money at play. Of course, good investment behaviours, like staying diversified, keeping fees low, not panic-selling, not timing the market, and staying the course, played the biggest role here.

A good strategy here is to make the bulk of your portfolio the S&P 500, while supplementing it with a few key Canadian stock picks. This way, you can match the bulk of the market’s performance while getting a chance to outperform if your picks do well.