Despite the recent relief rally, we’re still in the midst of a market correction. Year to date, the S&P 500 index is still down more than 15%. While it has eked its way out of bear market territory, which is defined as a 20% or greater drawdown, there might still be plenty of downside potential.

Some investors think they have a crystal ball. They spend days looking at charts, reading economic forecasts, and following the news. They might be tempted to pull their money out of the stock market, wait for a bottom, and then buy back in.

This is foolish (no pun intended) and is just another form of market timing, which is never advisable. At the Fool, we subscribe to a different philosophy that’s centered on holding a diversified portfolio of high-quality stocks long term. Here’s why investors should always stay the course.

A story of two investors

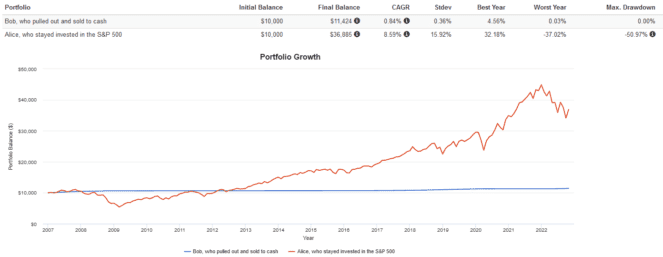

The year is 2007, and the Great Financial Crisis is about to kick off. We have two investors: Bob and Alice.

- Bob is a market timer who believes the market is about to crash. He sells all of his assets and holds cash to “buy back in at the bottom.”

- Alice is a passive investor who holds a S&P 500 exchange-traded fund, or ETF. She stays the course and remains invested for the long term.

Here’s what would have happened:

At the height of the crash, Alice would have lost 50.97% of her portfolio. However, by holding over the long term, she earned an annualized return of 8.59%. While Bob avoided the crash completely, his decision to stay in cash earned him a meagre annualized return of 0.84%. After accounting for inflation, he lost money.

Investors always think that a crash is always around the corner. Every day on the financial media, there will be some pundit predicting another crisis and urging investors to sell it all. As the saying goes: “even a broken clock is right twice a day.”

The issue here is that very few people can predict the market. The best solution for average folks like you and me is to invest in solid assets, contribute frequently, and stay the course when markets get rough. Time in the market will always beat timing the market.

What to buy?

If you’re looking for a good S&P 500 ETF to buy and hold for the long term, a good pick is Horizons S&P 500 ETF (TSX:HXS). HXS is especially good for taxable accounts, as it pays no dividends due to its corporate class structure. Its total return already reflects reinvested dividends.

HXS costs a management expense ratio of 0.1%, with a trading expense ratio of 0.1%. When combined, this is higher than other S&P 500 ETFs, but there is a catch. With HXS, you don’t incur a 15% foreign withholding tax on the dividends, as there are none paid, so it evens out in the end.

Despite my admonitions earlier against panic-selling and holding cash, there’s nothing wrong with holding a portion of your portfolio in cash to reduce risk. With bonds suffering due to rising interest rates, a cash allocation makes sense for lower-risk investors.

Not all investors have the risk tolerance to go 100% stocks, and that is OK. Holding 10%, 20%, or even 40% of your portfolio in a lower-risk asset is a good way to reduce volatility and drawdowns during bear markets and crashes.

A good ETF here is Horizons High Interest Savings ETF, which holds cash with Schedule 1 Canadian banks. Currently, this ETF has a gross annualized yield of 4.29% thanks to rising interest rates. It costs a management expense ratio of 0.13%.

Claim Membership Credit

Claim Membership Credit