Fast-growing water and electricity utility Algonquin Power and Utilities Corp (TSX:AQN) is going through a rough patch. Cash interest expenses shot up by 78% year over year during the last quarter while the business faced project construction delays and earnings nosedived. Although AQN stock has taken a beating, corporate insiders bought the dip. Should investors take insider purchases seriously?

What happened?

Following a significant post-earnings plunge in Algonquin Power’s stock price during the past week, the company’s president and chief executive officer (CEO) Arun Banskota started buying shares. Specifically, in mid-November, he acquired 120,000 AQN shares at $12.30 followed by another 11,000 shares at US$7.86 in the public market. He invested nearly $1.6 million of his own money, increasing his direct equity position in AQN by 172%.

The CEO wasn’t alone.

Three company directors joined him and acquired Algonquin Power’s shares on the public market worth about $922,000 during the past week.

Key insiders took advantage of an acute drop in their employer’s stock price. They actively bought the dip. These buys signal their confidence that AQN shares are undervalued, and they may know better than the market.

Should you follow?

Contrarian investors look for value stocks experiencing acute price drops that they believe should be temporary. Importantly, they trust management can fix the problem. As far as Algonquin Power’s challenges are concerned, that time to buy AQN stock could be now. Evidently, key insiders seem to strongly believe so.

Actually, Algonquin Power’s directors and an influential executive team are responsible for the company’s financial and operating strategy. This includes approving or cutting the utility’s dividend, which yields 9.6% today.

The company promised to provide a strategic update early in 2023. As things stand, only the insiders know what options are likely to be adopted next year. Investors remain uncertain about the company’s plans to survive the current interest rate and inflation headwinds. Nonetheless, AQN stock could soar (or crater) following a strategic update in the air.

That said, insider trading signals have their flaws. Company executives and directors have limited control of the business’s trading environment. In AQN’s case, management faces a number of headwinds beyond its control. They include rising interest rates, inflationary pressures on operating costs, and project construction delays.

Moreover, insiders can have an illusion of control and exhibit some mental biases about their capacity to turn things around for the business. Their investment decisions may also be clouded by emotions and loyalty. For these reasons, investors should study insider signals with caution.

Why I’d buy AQN stock today

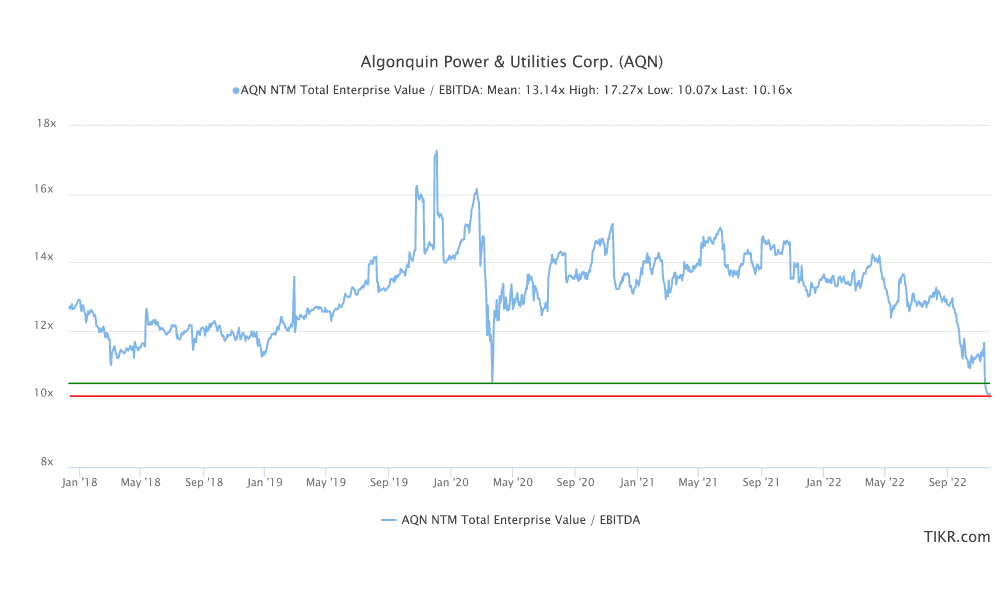

Algonquin Power’s high leverage is a genuine concern for investors as interest rates rise, and that’s also somewhat true for industry peers. However, that risk is priced into the stock. AQN trades at cheaper valuation multiples than it did during the onset of the COVID-19 pandemic when stock prices crashed to record lows.

AQN’s forward enterprise value-to-earnings before interest, taxes, depreciation, and amortization (EV/ EBITDA) multiple of 10.2 is lower than its five-year average level of 13.1 and lies below a 2020 market crash level of 10.5. Investment risk is high today, but what could be scarier about the utility’s business than a global pandemic that threatened humanity’s continued existence?

Enterprise value considers the value of both debt and equity interests in the business, excluding cash and marketable securities. The business is too cheap to ignore, especially considering the company’s strong market position as a regulated water and electricity utility with a growing renewable energy asset base.

Wall Street analysts’ forward EBITDA estimates include additions from a US$2.6 billion acquisition of Kentucky Power Company and AEP Kentucky Transmission Company. These acquisitions will add to Algonquin’s regulated asset footprint. The deal may close in January 2023 and start augmenting cash flow generation.

A low valuation

Algonquin’s management could decide to wait on the Kentucky consolidation before announcing strategy modifications for the business. That possibility adds more uncertainty over AQN’s stock valuation for now – thus, the major valuation discount.

Management could cut the dividend, but that’s likely. However, the company’s regulated cash flow base has the capacity to rebuild its balance sheet and support dividend growth back to current (9.6% yield) levels in the future. Yet shares may never be this cheap again.

That said, no matter how compelling the AQN stock investment case may be, diversification is always advisable.