The Canadian equities market continued to trade on a slightly positive note for a second consecutive session on Wednesday, despite the latest Fed meeting minutes indicating more rate hikes in 2023. The S&P/TSX Composite Index rose 145 points, or 0.7%, yesterday to settle at 19,589.

Notably, the West Texas Intermediate crude oil futures prices have tanked by more than 8% in the first two trading sessions of the new year, as demand concerns amid the slowing global economy kept commodity investors worried. As a result, big losses in oil and natural gas prices dragged energy stocks downward yesterday as well. Nonetheless, a sharp rally in other key market sectors, like healthcare, real estate, metals mining, and technology pulled the TSX benchmark higher.

Top TSX movers and active stocks

Equinox Gold, Canopy Growth, Dye & Durham, Torex Gold Resources, BlackBerry, and Bausch Health Companies were the top-performing TSX stocks on January 4, as they inched up by at least 7.9% each.

In contrast, shares of Nexgen Energy and ECN Capital fell by more than 4% each, making them the worst performers on the Toronto Stock Exchange for the session.

According to the daily trade volume data, TD Bank, Bank of Nova Scotia, Barrick Gold, and Suncor Energy were the most active stocks on the exchange.

TSX today

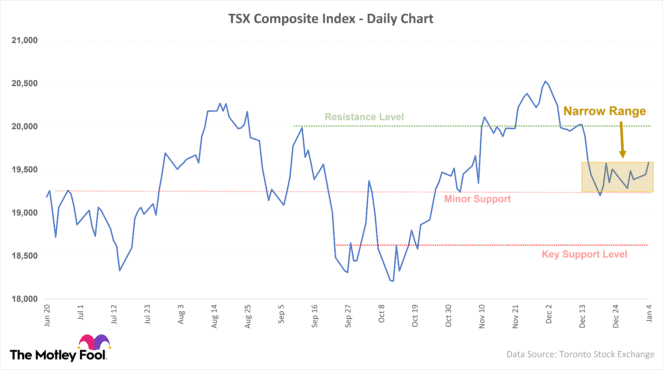

While the TSX Composite has managed to start 2023 on a slightly positive note, despite weakness in the energy sector, it has largely been confined within a narrow range since mid-December, as shown in the index chart above. Continued trading within this narrow range clearly reflects indecisiveness among market participants as they look for new macroeconomic triggers.

Early Thursday morning, oil and base metals prices were staging a recovery. In contrast, gold and silver prices, which witnessed a sharp rally in the last couple of sessions, were trading on a bearish note. Given these reversals, I expect the main TSX index to open on a flat note today and remain volatile.

On the economic events front, Canadian investors may want to keep an eye on the weekly jobless claims, crude oil stockpiles, and monthly non-farm employment data from the U.S. market this morning.