Following a difficult 2022, investors in Lightspeed Commerce (TSX:LSPD) stock have witnessed a 25% pop during the past month. Most of the gains happened in January. Shares in the commerce software vendor have soared by 20% so far in 2023. Chances are high that the small-cap tech stock has experienced a January effect. However, there’s also some potential for Lightspeed stock to soar some more this year.

Canadian stocks have generally performed well in January, and the TSX is up more than 5.9% so far this month. The January effect is an age-old market phenomenon where stock prices generally rise in January more than in any other month, and small-cap stocks outperform larger peers. It remains to be seen whether the market has experienced a January effect in 2023, or whether there’s a new wave of optimism that may lift the TSX (and LSPD stock) further during the remainder of the year.

Macro-level drivers may lift Lightspeed Commerce stock

Yester-year’s strong wave of investor pessimism could be giving way to “more stable” emotions and sentiments in 2023. Perhaps investors are readjusting their opinions on future interest rate hikes, further pushing out their recession timelines, or just warming up to a not-so-gloomy future. Should this be the case, the TSX, and especially growth stocks that were bashed a few months ago could recover this year.

A rising tide lifts all boats, and Lightspeed stock could rise with the broader market in 2023.

That said, Lightspeed Commerce’s stock has some valuation drivers that investors need to watch closely this year.

Company-specific value drivers for LSPD stock in 2023

Lightspeed is a high-growth stock that could show some capacity toward turning profitable over the next few quarters. The company is still growing its revenue at high double-digit growth rates and could sustain its growth spree in 2023. Sustained growth, with some hint towards profitability, could support a soaring LSPD stock.

Most noteworthy, Lightspeed intends to complete the integration of its prior acquisitions into one company this year. Instead of selling various platforms in various markets around the world, the company will sell just one brand, Lightspeed Retail, and Lightspeed Restaurant before the end of 2023. If successful, the integration will reduce organizational complexity, reduce costs, and potentially improve customer uptake globally.

Lightspeed’s goal to drive payments adoption across existing customers should be a key revenue and earnings growth driver in 2023. There’s ample room for the company to convert more of the gross transaction volume (GTV) on its commerce platforms into gross payments volume (GPV) on its payments network.

During the most recent quarter, which ended in September 2022, Lightspeed’s GPV of US$3.7 billion (up 86% year over year) was less than 17% of its GTV of US$23.8 billion (on a constant currency basis) during the quarter. There’s ample room for the company to deepen the adoption of its payments platform by its existing customers. Payments adoption should be a major growth area for the company and a key profitability driver this year.

Shares could rally further in 2023 if Lightspeed can show a clear path toward its positive adjusted earnings before interest, taxes, depreciation, and amortization expenses (Adjusted EBITDA) during the year.

Key risks to watch on LSPD stock in 2023

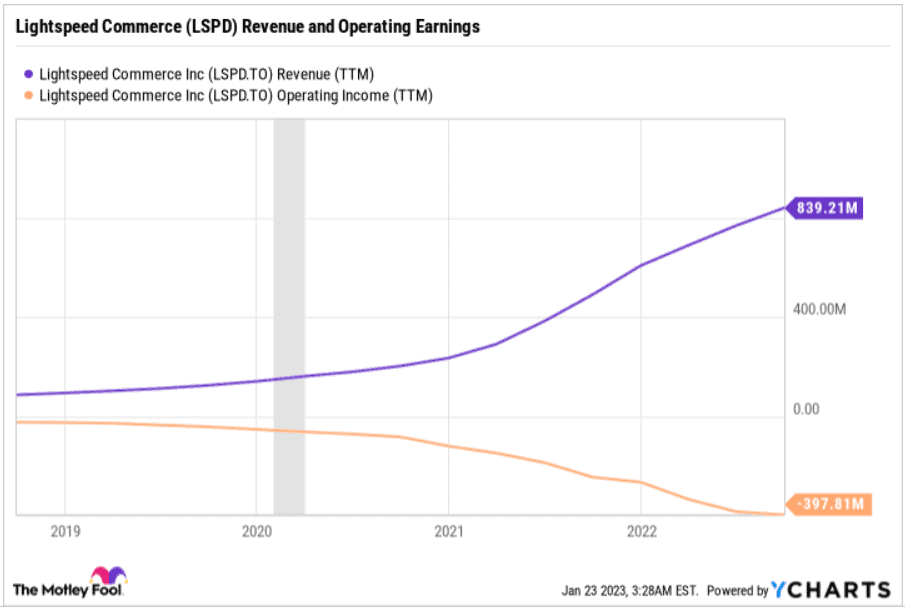

Lightspeed has been a persistent loss-maker throughout its history. The company’s growing revenue base has been associated with deepening operating losses, and this phenomenon exposed the company to short-seller attacks. Investors may remain skeptical if the trend persists in 2023.

Losses have been widening with sales growth, but there’s some hint of stability lately. Investors should continue to monitor and track how the business turns a corner in 2023. Operating losses appear to be stabilizing lately.

Further, a tightening North American economy could complicate Lightspeed’s path to profitability. The company noted that, on a customer-by-customer basis, average transaction volumes have been shrinking from prior year levels as consumer spending shifted in 2022. Lightspeed does a lot of business with consumer discretionary, specialty retail, sporting goods, and home improvement retailers. The company has been seeing some year-over-year same-store volume declines in those categories lately. A recession could complicate matters in 2023.