Many investors who experienced their first bear market in 2022 are likely nervously sitting on a pile of cash on the sidelines. After all, who wouldn’t love to perfectly time the market bottom and buy back in when prices are low across the board?

The problem is that markets are highly unpredictable. Case in point, consider the recent January rally that saw the NASDAQ 100 soar 10% in a month after a brutal year of losses. Investors who missed that rally by holding cash probably lost out and are now piling back in after the rally.

There’s nothing wrong with a six-month emergency fund held in a savings account, but if you want to grow your investment portfolio, there are better ways to invest your spare cash. Let’s walk through a historical example to understand why savers lose to investors over the long term.

Savers vs. investors: 1999-2023

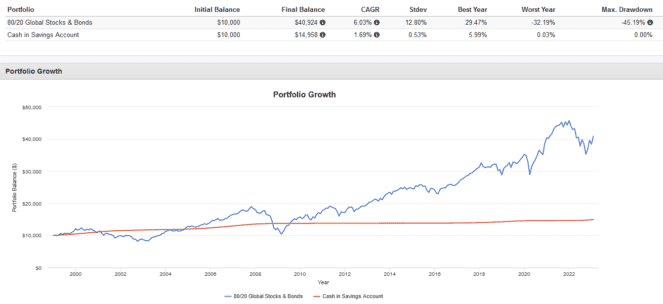

For our historical backtest, I picked the last 20 years or so. This time period covers the 2000 Dot-Com Bubble, the 2008 Great Financial Crisis, the 2020 COVID-19 Crash, and the 2022 bear market.

We have two investors. One held an 80/20 portfolio of global stocks and bonds, and one only invested in a savings account. Both investors started with $10,000. Let’s see what they ended up with:

Initially, the investor had a rough go. Their portfolio was in the red for a few years due to the Dot-Com Bubble. Once it recovered somewhat, the 2008 crash wiped it out again. During this time, they had to endure high volatility. Meanwhile, the saver enjoyed a steady portfolio value.

However, over the next decade things changed. As time went on and the market recovered, the investor saw their portfolio grow. In contrast, the saver barely earned anything! After inflation, the saver actually lost money with an inflation-adjusted portfolio value of $8,260.

How to invest long term

If your time horizon is measured in decades, and you can tolerate some risk and volatility, then being an investor is the way to go. Savings are great for short-term goals but aren’t a substitute for a long-term investment portfolio.

My ideal way of investing is hands-off via an exchange-traded fund (ETF). My favourite ETF is Vanguard Growth ETF Portfolio (TSX:VGRO), which hold 80% in U.S., Canadian, and international stocks, and 20% in Canadian, U.S., and international bonds.

The ETF is highly diversified, holding 13,668 stocks and 18,333 bonds. It rebalances itself periodically and pays out dividends on a quarterly basis. With VGRO, your investment strategy becomes as simple as buying more, reinvesting dividends, and holding for the long term.

In my opinion, a great way to use VGRO is to make it the core holding of your portfolio. Then allocate a small amount of money to pick few high-conviction Canadian stocks (and the Fool has some great recommendations for those below).