Fellow Fools,

One minute you’re enjoying a beautiful sunny day, skiing with your family in Quebec.

The next … a bank you’ve recommended to thousands of paying members has an unprecedented run on deposits and evaporates before your very eyes.

That was me last week as SVB Financial became the second-largest bank to go “boom” in U.S. history.

Not ideal. To say the least.

We’d never experienced that before in Stock Advisor Canada — our flagship, members-only advisory service that I lead – and of course we’d prefer to never live through that again.

Since then, it’s been a wild ride for U.S. bank stocks, the banks themselves, and even their customers.

And we’ve been given a moment to take a deep breath, puff out our chests, and take pride to be Canadian.

Go, Canada

Throughout history, as bank failure after failure has occurred in the U.S., we Canadians have been able to sleep easy, knowing our system is as sound as can be.

It may not be flashy, but it works.

Right?

Not so fast.

It’s well understood that the “Big 5” Canadian banks spent decades consolidating the financial services landscape in Canada.

When that was done, they turned their sights beyond the Canadian border. After all, shareholders demand growth, and with consolidation complete, the Canadian landscape had become relatively barren.

Via a string of acquisitions that began in earnest with TD Bank’s (TSX:TD) majority acquisition of Boston’s Banknorth in 2004, many Canadian banks have diversified rather significantly away from their geographic roots.

Here’s where each of the Big 5 derived their 2022 revenues:

| BMO | TD | Royal Bank | CIBC | Scotia | |

| Canada | 47.40% | 59.64% | 59.11% | 74.48% | 59.25% |

| U.S. | 50.37% | 37.61% | 24.18% | 14.88% | 6.86% |

| Other | 2.23% | 2.75% | 16.71% | 10.64% | 33.88% |

Surprised?

And this table doesn’t even tell the full story.

TD is attempting to acquire Memphis-based First Horizon (NYSE:FHN) in a deal that was supposed to close in February but has been pushed to May.

First Horizon had revenues of $2.7 billion in 2022, all from the U.S. If we assume this transaction closes, then TD’s percentage of U.S.-derived revenues shoots up to 41%.

(Incidentally, TD has agreed to pay $25 per share for First Horizon. The widespread malaise over the past week has those shares trading at just ~$15 as I write.)

The message is, as customers, we Canadians can feel good about our banks.

However, as investors, exposure to the Canadian banks means that we’re also exposed to the chaos that’s taken hold in other countries’ financial sectors.

That is, exposure to most of the Big 5 Canadian banks.

Bank of Nova Scotia (TSX:BNS), come on down!

With a mere 7% of its 2022 revenues derived from the U.S., suffice it to say that Scotia is a relative beacon when it comes to avoiding the entire messy situation south of the border.

But wait – the story gets better.

You see, when it comes to bank stress-test scenarios, we don’t think we’ll ever encounter a worse situation than the Great Financial Crisis of 2008-2009. What’s going on right now smells like a bouquet of roses in comparison.

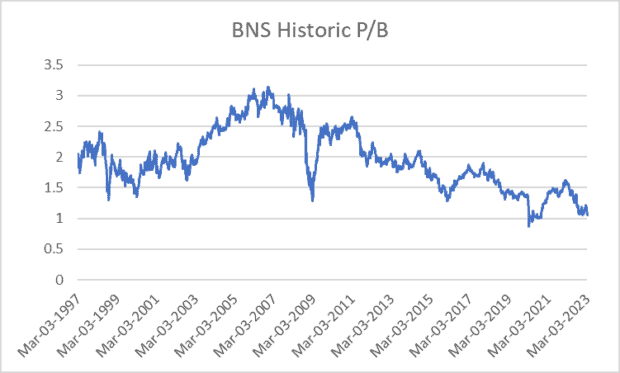

Yet … Scotia trades for a valuation, as shown in the historical Price/Book Value chart below, that’s lower than it was during the most stressed period banks anywhere are likely to ever encounter again.

This doesn’t make any sense to us, which is why we’ve made Scotia the lone “Big 5” Canadian bank that we’ve ever recommended in Stock Advisor Canada on a standalone basis. (We have another angle to play the Canadian banks, but out of respect to our paying members, I’ll keep that one under wraps.)

That Scotia is the “Big 5” Canadian bank with the least exposure to the U.S. merely adds intrigue to this investment.

Foolish Bottom Line

Let’s be clear.

The Canadian banks have been bedrock positions in the portfolios of generations of Canadian investors. This should continue. After all, they’re wonderful companies that enjoy an enviable competitive situation.

Right now though, I think one stands above the rest when it comes to warranting an investment of your hard-earned savings.

And heck, I haven’t even mentioned the 6.3% dividend yield that Scotia currently offers.

I don’t throw the term “no-brainer” around with much frequency. But it’s certainly in the conversation when it comes to this situation. Fool on!