Canadian stock analysts, fondly known as Bay Street analysts, and their American counterparts (Wall Street) have a consensus Strong Buy rating on Lithium Americas Corp (TSX:LAC) stock. However, the average price target on this most promising development-stage lithium growth stock is striking. Bay Street bets LAC stock could nearly double over the next 12 months, and growth-oriented investors should take notice. A potential 93.5% gain on Lithium Americas stock during the remainder of 2023 could awesomely rock a retirement portfolio.

Lithium Americas is a $4 billion development-stage lithium mining house whose Caucharí-Olaroz asset in Argentina could report its first production this first half of 2023. Its recently licensed Thacker Pass project in the United States breaks new development ground this year and has already attracted a US$630 million (C$848 million) strategic investment from General Motors.

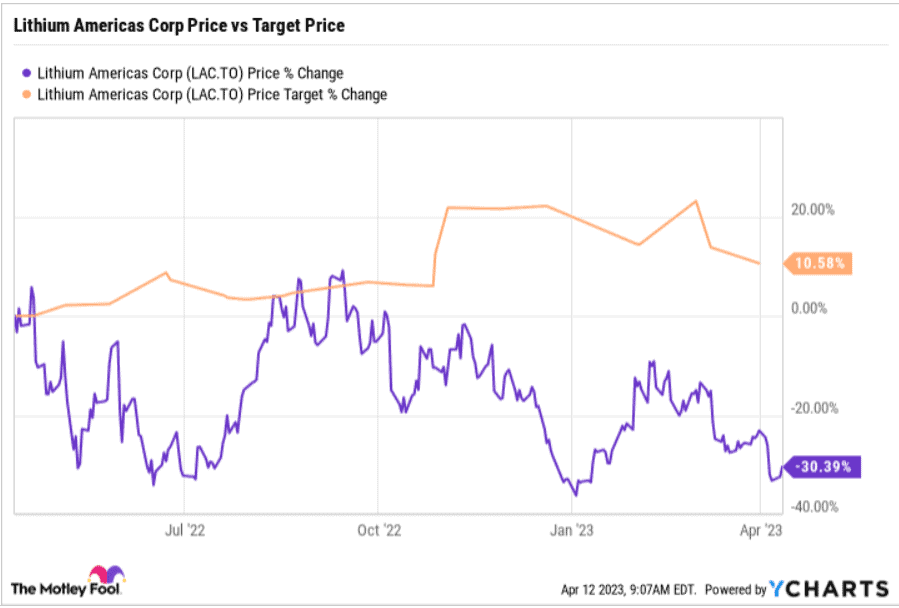

The average analyst price target on Lithium Americas stock of $51.49 implies a strong 93.5% upside over the next 12 months. Bay Street has increased its price target on the lithium stock by 11% over the past year, even as the share price declined by 35% during the period.

Investment professionals are bullish on the company’s future prospects, and the current dip in LAC stock price could be the entry point the markets have generously gifted to growth investors.

Is it time to buy Lithium Americas stock?

Lithium Americas stock is becoming more valuable as the company partially graduates from a high-risk development-stage project owner into a lower-risk production-stage miner with growing revenue. In the meantime, it is generating some cash flow to reduce dependence on dilutive external funding.

The company expects its first lithium production during the first half of 2023 at its Caucharí-Olaroz project in Argentina. Bay Street analysts project more than US$89 million in revenue in 2023 before a 600% surge in sales to US$630 million in 2024 as the company ramps up production to a target of 40,000 tonnes per annum.

Further, Lithium Americas should benefit substantially from the United States’s government policies as North America strives for self-sufficiency in the critical EV industry supply chain. Geopolitical strains between the U.S. and China give impetus to a largely American-controlled EV battery supply chain, and American lithium projects should enjoy some smooth sailing going forward. China currently controls world lithium and battery production.

Most noteworthy, the recent drop in LAC stock is a buying opportunity for much more generic reasons outlined below.

The bigger positive picture for lithium stocks right now

The bullish long-term narrative for lithium stocks appears simple.

Lithium stock prices rise and fall somewhat in line with lithium commodity prices. Investor sentiment rises and wanes with the commodity’s price swings. Prices affect the expected values of lithium reserves and project net asset values. Given the strong rally in lithium carbonate prices in 2022, and a precipitous plunge so far in 2023, it’s highly likely that lithium prices may remain volatile in the future, and the good times may come back once again. The narrative is speculative, but it holds water.

Lithium is a crucial component of current electric vehicle (EV) and green energy storage battery technology. It may remain as such for many more decades to come. Demand for lithium should keep growing as EV production gathers pace and government bans on combustion engines take effect, while more solar and wind power projects come online. Renewable energy plants generally require battery storage to stabilize their feeds into the grid.

Although a critical component, lithium is also a very small percentage of total EV battery components – as low as 3.2%. Higher lithium prices may not necessarily cause outrageous price increases on batteries. Low price elasticity (responsiveness of demand to price changes) for lithium carbonate provides some pricing power to producers.

Interestingly, market chatter is that some Chinese lithium powerhouses are considering a price floor. Lithium miners may get away with price floors (minimum prices for their production). They have the incentive to collude and copy what oil miners do.

After all, lithium could be the new oil!

Investor takeaway

Investors with a long-term view may buy the current dip on Lithium Americas stock, wait for another lithium bull run, and book beautiful gains as the company graduates into a self-sufficient, de-risked lithium producer over the next decade. Shares could double sooner.