Investing is a get-rich-slow game. Sure, some lucky folks hit home runs with meme stocks, cryptocurrencies, or day trading. What you don’t see is the majority of people who strike out and lose it all. To put it bluntly, investments that promise you’ll get rich quick are usually scams or highly risky bets.

Instead, focus on keeping manageable sources of risk under control, such as avoiding high fees, resisting the urge to chase hot assets or panic-sell, and keeping your savings and contribution rate high. These factors play a role as large as selecting the ideal investment.

Heck, with these under control, you don’t even have to worry about picking the right stocks. An exchange-traded fund (ETF) tracking a diversified index will do the trick just fine. Here’s a real-life example to prove it.

All-in on the S&P 500

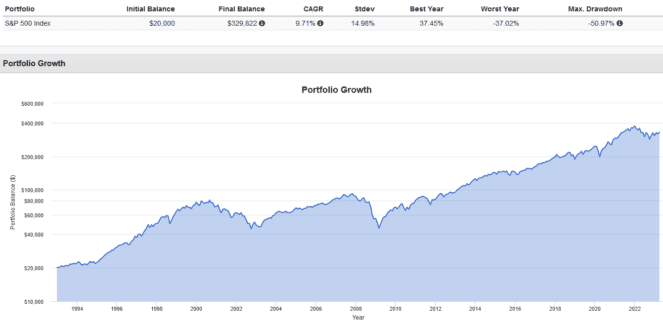

Let’s suppose you began investing 30 years ago in 1993 as a 25-year-old with $20,000 available. You decided to keep it simple and dump it all into a low-cost ETF tracking the S&P 500 index.

Effectively, your $20,000 was spread out among 500 U.S. companies from 11 stock market sectors, where the winners rose to the top and the losers were cut from the index. You also committed to reinvesting any dividends promptly as soon as they were paid out.

Most importantly, you never panic-sold, even when the markets tumbled in 2000, 2001, 2002, 2008, 2018, 2020, and 2022. By March 31, 2023, your original $20,000 investment would have grown to $329,822 at an average annualized 9.71% return.

The cool part? This took nothing more than holding a low-cost index ETF, consistently investing more, reinvesting dividends, and never panic selling. You didn’t need to follow the financial news, pick stocks, or do a ton of research.

Finally, if you invested additional amounts consistently, your final result would have been even greater. That’s the power of compounding at play.

ETF choices you can use

ETF provider iShares has two options investors can use when it comes to investing in the S&P 500 index, with one being a Canadian-listed ETF and the other a U.S.-listed ETF.

For a Registered Retirement Savings Plan (RRSP), iShares Core S&P 500 ETF (NYSEMKT:IVV) is ideal. As a U.S.-listed ETF, IVV isn’t subject to the Internal Revenue Service’s 15% foreign withholding tax on dividends paid when held in an RRSP. Plus, IVV charges a super-low expense ratio of 0.03%.

For a Tax-Free Savings Account (TFSA), iShares Core S&P 500 Index ETF (TSX:XUS) is better. Since the TFSA isn’t exempt from foreign withholding tax, there’s no benefit in converting currency and holding IVV here, so you might as well buy XUS, which trades in Canadian dollars. XUS’s expense ratio is slightly higher at 0.10%.

Bottom line

IVV and XUS are both simple, yet highly effective low-cost investments that are great as a core portfolio holdings. To diversify even further, think about adding a few Canadian stock picks alongside IVV and XUS (and the Fool has some suggestions below).

Claim Membership Credit

Claim Membership Credit