Imagine you’re sailing in open waters. Some days, the sea is calm, your journey smooth. Other days, the waves rock your boat wildly, making your trip risky and unpredictable. The world of investing can feel very much like this, especially when the markets get turbulent, or “volatile,” as investors say.

But what if you could choose a boat better built to withstand those choppy waters? In the world of investing, these resilient boats are often referred to as “low-volatility” or “low-beta” stocks. But what does this actually mean?

Here’s a quick primer on how to identify low-beta stocks, along with a few suggestions and my exchange-traded fund, or ETF, pick for quickly investing in a diversified portfolio of the top low-beta stocks.

How does beta work?

In simple terms, “beta” is a measure used in finance that shows how much a particular stock tends to move compared to the overall market.

If a stock has a beta of one, it typically moves with the market. If it’s more than one, it tends to change more than the market, so it could offer higher gains when the market rises, but it might also fall harder when the market drops.

On the other hand, a stock with a beta less than one tends to be less volatile during market downturns. A beta of zero implies that the stock has historically been totally uncorrelated with the market’s gyrations. A negative beta implies that the stock has historically moved opposite of the market.

This is where low-beta stocks come in. They are like the sturdy boats that are less affected by the big waves — they might not get you to your destination as quickly when the sea is calm, but they are more likely to keep you afloat when the sea gets stormy. In investing, sometimes minimizing the downturns is more important than chasing big gains.

Important note to remember: low beta does not mean that the stock is safe. Beta is a historical-looking measure. A change in a company’s fundamentals can result in losses even with a low beta. When the market crashes suddenly, all stocks, even low beta ones, can be affected. Market risk is unavoidable.

Picking low-beta stocks

An easy way to look for low-beta stocks is by using various online stock screening services and filtering for those with a five-year monthly beta of lower than 0.5. For example, I found the following Canadian picks:

- Fortis: 0.17

- Hydro One: 0.25

- Loblaw Companies: 0.06

Or you can save yourself the trouble by buying the BMO Low Volatility Canadian Equity ETF (TSX: ZLB), which holds all three of those companies plus numerous other low-beta stocks like Metro, Barrick Gold, Thompson Reuters, and Emera for a 0.39% expense ratio.

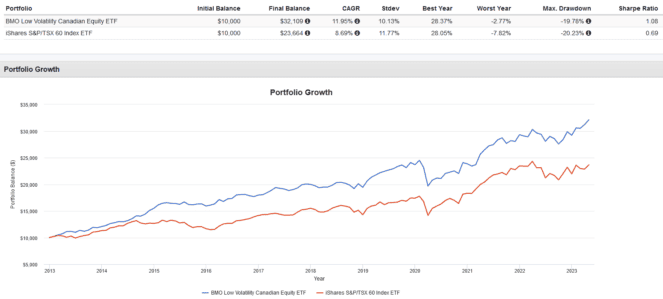

Historically, ZLB has beaten the benchmark iShares S&P/TSX 60 Index ETF with higher returns and lower volatility and drawdowns for an overall superior risk-adjusted return since 2013. That’s not too shabby!

Stock Up Sale

Stock Up Sale