Alright, here’s the bottom line up front: I think Canadian National Railway (TSX:CNR) and Canadian Pacific Railway (TSX:CP) are equally good buys and two of the best stocks in Canada. Why? I think its a good idea to play both sides of a duopoly, especially when both companies benefit from the same wide moat.

That’s right; these two giants in the Canadian transportation industry hold a duopolistic position, making them “wide-moat” stocks that have the potential to offer sustained growth and consistent returns owing to a perennial lack of competition. Forget metrics and numbers — here’s the business case.

Understanding wide-moat stocks

A term coined by legendary investor Warren Buffett, “wide moat” in the context of stocks refers to a company that holds a significant competitive advantage over its rivals. Companies possessing a wide moat can generate higher profit margins and ensure stable, long-term growth.

In Canada, the railway industry possesses significant barriers to entry, including regulatory hurdles and the capital-intensive nature of establishing and maintaining a viable railway infrastructure. This scenario has resulted in an oligopolistic structure, dominated by CNR and CP for decades.

This duopoly provides a stable competitive environment, as it is unlikely to see new entrants. Both companies have continued to expand and improve their service offerings and have increased their market share in North America via acquisitions, enhancing their wide-moat status.

The benefits of wide-moat investing

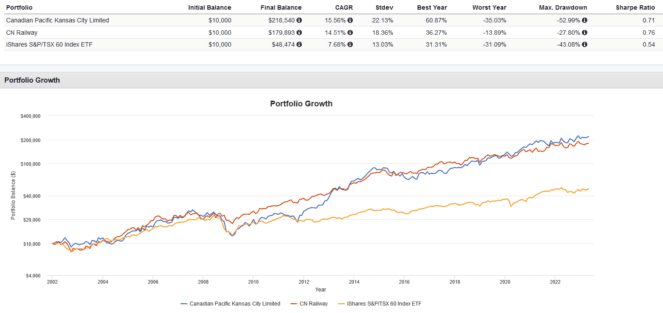

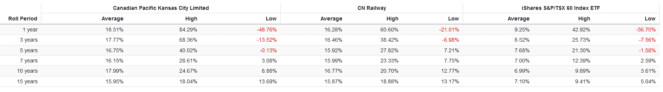

The effects of this wide moat can be seen with both company’s stock prices historically, with CNR and CP outperforming the benchmark S&P/TSX 60 Index over a 21-year trailing period since 2002. The rolling returns show similar results over many intervals, which are less biased to start and end dates.

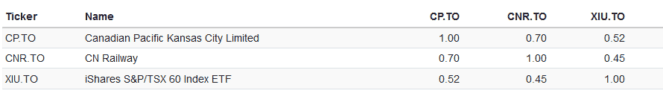

Here’s another reason to hold both stocks: CP and CNR aren’t perfectly correlated. Right now, the monthly correlation between both stocks is 0.70. They don’t always move in the same direction or magnitude, thus suggesting that by buying both and re-balancing periodically, investors could achieve similar returns while lowering risk.

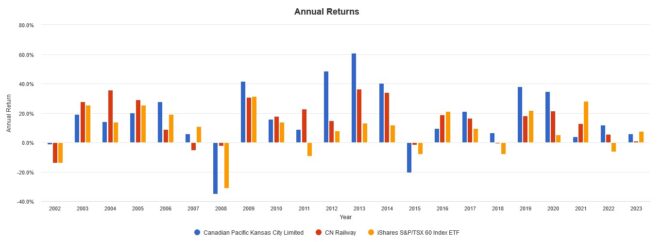

This point is underscored by looking at each stock’s historical returns on an annual basis. Some years, CP outperforms, while other years, CNR outperforms. However, as seen in the trailing and rolling returns earlier, both stocks have performed similar over the long run.

Thus, smart investors who understand the benefits of diversification can hold both, electing to re-balance periodically to buy the loser while trimming profits in the winner. This strategy helps investors “buy low and sell high,” which is something that many struggle to do consistently.

Long story short: I don’t think either stock is a better buy. Both are vital component of Canada’s railway duopoly. In my opinion, there’s scant benefit to focus solely on one. Buying both is a free lunch from my point of view.