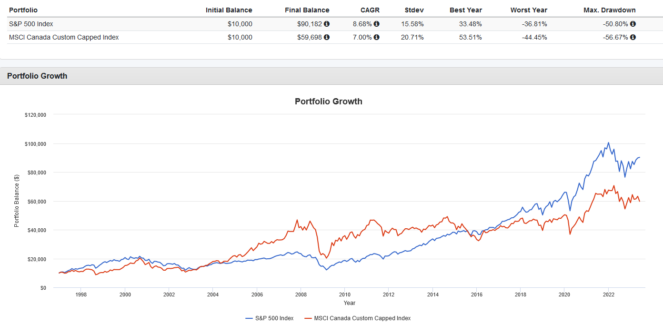

Here’s a question: which has historically offered a higher rate of growth — the U.S. or Canadian stock market? The results are below:

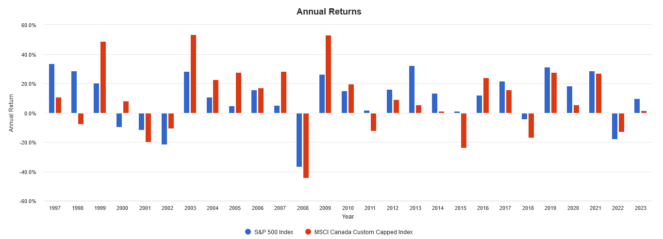

Since 1997, the U.S. market has won after adjusting for currency differences, but there are some caveats. First, most of the outperformance came post 2015, where large-cap growth stocks from the tech sector went on a epic bull run.

Second, there are years where Canada did significantly better, such as between 1999 and 2009. In this period, Canada’s ability to avoid the worst of the dot-com bubble and stagnation did wonders.

Still, given that Canada only comprises 3% of the world by market-cap weight, an allocation to U.S. stocks may be a good idea for diversification. In contrast, the U.S. market accounts for 60% of the world by market-cap weight.

Here’s a look at two of my favourite exchange-traded funds (ETFs) from BMO Global Asset Management that offer exposure to U.S. stocks.

The S&P 500 Index

You can’t have an article on U.S. stocks without mentioning the venerable S&P 500 index. Composed of 500 mid- and large-cap stocks selected by a committee to be representative of the overall U.S. market, this index is very hard to beat over the long term, whether by professional or retail investors alike.

The upside of this, however, is simple. By investing passively in the S&P 500 index and keeping costs low, you have a good shot at beating most investors. A great ETF to use for this purpose is BMO S&P 500 Index ETF (TSX:ZSP), which charges a low expense ratio of just 0.09%.

The Nasdaq 100 Index

What if you’re looking for greater growth potential and are comfortable with higher volatility? A possible alternative to the S&P 500 is the Nasdaq 100 index, which tracks the 100 largest non-financial stocks listed on the Nasdaq exchange. It is very growth stock and tech sector heavy as a result.

For exposure to the Nasdaq 100, a great ETF to consider is BMO NASDAQ 100 Equity Hedged to CAD Index ETF (TSX:ZQQ). This ETF is more expensive than ZSP with a 0.39% expense ratio and uses currency hedging to minimize the volatility from fluctuations in exchange rates.