If you’ve ever speculated about how your financial circumstances would have changed if you’d made that crucial investment at the right time, this article will put those worries to rest.

Picture this: the year is 2008, and amid the swirling turmoil of a global financial crisis, you’ve chosen to invest $1,000 in Telus (TSX:T).

As a pillar of Canada’s telecommunications oligopoly, Telus has stood firm within a triumvirate, alongside Rogers Communications (TSX:RCI.B) (which has since absorbed Shaw) and BCE (TSX:BCE), effectively minimizing competition and fostering an environment ripe for stable growth.

Let’s chart the journey of Telus’s stock price from 2008 to the present day to understand the power of dividend growth and the magic of compound returns. I’ll also leave you with what I would personally rather invest in today instead of Telus.

Looking backwards in time

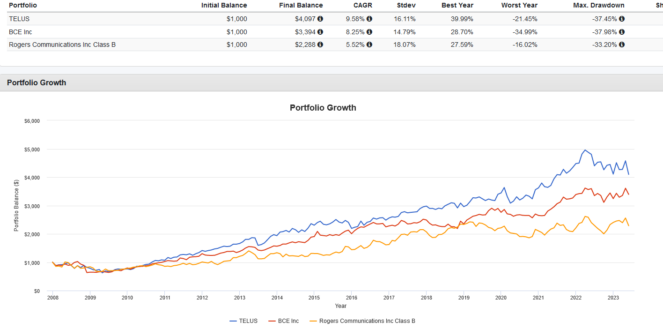

If you did indeed invest $1,000 in Telus at the start of 2008, your investment would have paid off handsomely.

Despite losses during the Great Financial Crisis, your initial $1,000 investment would have quadrupled to $4,097 by the end of May 2023 for an annualized return of 9.58%. Give yourself a pat on the back for also beating Rogers and BCE!

However, keep in mind that these returns are hypothetical and assume that all dividends are reinvested perfectly on time, there was no tax paid, and there were no transaction costs incurred.

This is also backwards looking. I wouldn’t be able to tell you today whether or not I think Telus will continue to beat BCE or Rogers, or even the overall market. As the saying goes: “Past performance does not predict future performance.”

What I would do instead

I would never invest in just Telus. I don’t care if it currently leads the telecom mafia, the risk of a single stock tanking a large part of my portfolio is too much for my risk tolerance. What I would do instead is diversify by buying an exchange-traded fund (ETF) with high exposure to Telus, but also other stocks.

My pick today is Horizons Canadian Utility Services High Dividend Index ETF (TSX:UTIL). This ETF currently holds 10 of Canada’s leading Canadian utility, telecom, and pipeline companies in equal weights, screened for above-average dividend yields. Its current portfolio includes the following:

- Utilities: Brookfield Renewable Partners, Brookfield Infrastructure Partners, Fortis, Emera, and Hydro One.

- Pipelines: Enbridge and TC Energy.

- Telecoms: Rogers Communications, Telus, and BCE.

For a 0.62% expense ratio, investors gain exposure to all of these companies, with an estimated annual dividend yield of 3.99%. As a bonus, this dividend is paid out on a monthly basis instead of quarterly.