Throughout his illustrious career, Warren Buffett, the Oracle of Omaha, has imparted invaluable wisdom about investing strategies, but not all of it has been consistent with his unique value investing strategy,

Notably, in his 2014 letter to Berkshire Hathaway shareholders, he advised his trustees to invest most of his estate in a S&P 500 index fund upon his passing. This sage advice, which underscores the power and potential of the S&P 500 as a growth engine, is not only relevant for Americans but also Canadians.

Buffett himself emphasized the value of S&P 500’s diverse exposure and the hard-to-beat nature of its long-term returns. He even won a bet against notable hedge funds after claiming that they would lose to the index long term.

Let’s unpack why the S&P 500 might just be your best bet for achieving robust and sustainable financial growth.

It is highly diversified

The S&P 500 is a stellar representation of the U.S. equity market because of its comprehensive sector diversification. Currently, the index includes companies from all 11 sectors of the Global Industry Classification Standard (GICS).

But it’s not just any company that can earn a spot in the S&P 500. This illustrious index has a stringent selection process that ensures quality in its holdings, notably in the form of criteria for sufficient market capitalization and a long enough track record of positive earnings.

The S&P 500 is also occasionally reconstituted, meaning underperforming companies are removed and replaced by more successful ones. This ensures that the index stays robust and relevant, which is not necessarily true for individual investors’ portfolios.

Therefore, by tracking the S&P 500, investors can gain exposure to a broad spectrum of industries, thus lowering sector-specific risk and ensuring a healthy blend of both growth and value stocks. You get the average return of the U.S. market, which, it turns out, is very hard to beat.

It’s hard to beat

Don’t believe me? Consider the results of the most recent SPIVA Scorecard from S&P Dow Jones Indices. This survey measures the performance of various funds against their index benchmarks.

When it came to the S&P 500, SPIVA found that over the last 15 years, 93.40% of all U.S. large-cap funds failed to beat it. In other words, only 6.60% of funds managed to outperform the S&P 500 over the long term.

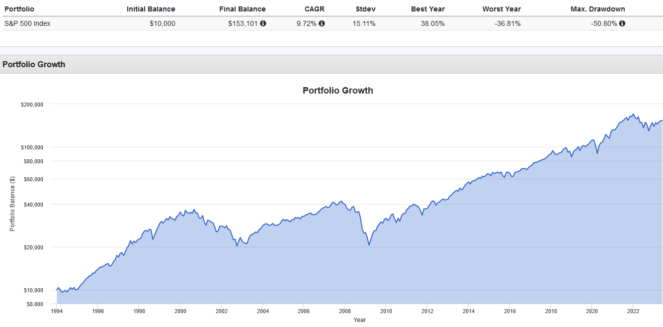

From 1994 to May 2023, an investor who put $10,000 into an S&P 500 Index fund and did nothing other than reinvest dividends and passively hold would have earned an annualized 9.72% return, turning that $10,000 into $153,101.

Index ETFs to buy

The best part of investing in the S&P 500 is that it requires almost zero effort beyond buying and reinvesting dividends.

Trying to beat the S&P 500 often involves active trading, which can lead to higher transaction costs and tax inefficiencies. In contrast, investing in an S&P 500 index fund generally involves lower expenses due to its passive management style.

My preferred tool here is an S&P 500 exchange-traded fund (ETF). In the Canadian market, investors have a few popular picks to choose from, which include:

- BMO S&P 500 Index ETF

- Vanguard S&P 500 Index ETF

- iShares Core S&P 500 Index ETF

All three ETFs provide direct exposure to the S&P 500 index by replicating its current portfolio of stocks. Each ETF is also very inexpensive, costing expense ratios of 0.09-0.10%.