As Canadian investors, it’s often easy to focus our investments close to home, but an essential aspect of a well-rounded investing strategy is diversification. Not just among asset classes and industries, but geographically as well. By broadening our geographical horizons, we open up our portfolios to a world of exciting opportunities and advantages.

Today, I’ll use historical data to illustrate the benefits of diversification, particularly the importance of including U.S. equities in your portfolio. Hopefully, the backtests I’ll review will persuade you why investing in the American market could potentially reduce portfolio risk. I’ll also leave you with one of my favourite exchange-traded fund, or ETF picks for accessing U.S. stocks.

A brief history lesson

One of the central tenets of investing is diversification, which involves spreading your investments across various assets to reduce risk. But diversification isn’t just about varying asset classes or sectors; geographical diversification can also be a critical factor, especially when considering the U.S. and Canadian stock markets.

These two markets, due to their different sector compositions, have historically shown cyclical performance patterns that don’t always mirror each other.

The S&P 500, a benchmark for the U.S. stock market, is heavily weighted towards technology, healthcare, and consumer discretionary sectors. The S&P/TSX 60, representing the Canadian market, is more inclined towards financials, energy, and materials sectors.

These sector compositions give each market unique strengths and vulnerabilities, leading to times when one outperforms the other. An analysis of the past few decades reveals an interesting pattern.

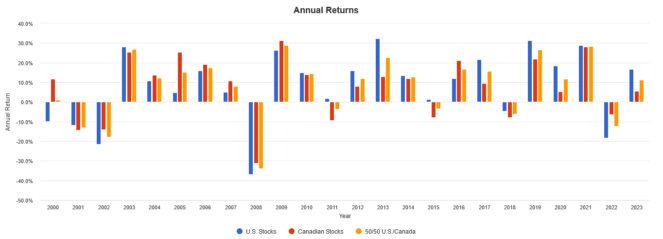

From 1999 to 2023, the U.S. and Canadian markets have taken turns outperforming and underperforming each other. There have been periods when the technology-heavy U.S. market has surged ahead, and other times when the resource-oriented Canadian market has led the way.

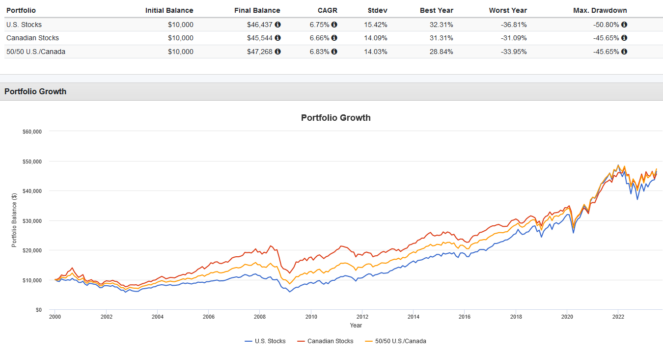

What does this cyclicality mean for investors? It reduces portfolio volatility and smooths out returns over time. By splitting a portfolio 50/50 between the S&P 500 and S&P/TSX 60, an investor would have been able to capitalize on the periods of outperformance in both markets, as seen below:

Moreover, this balanced approach would not only have resulted in similar returns compared to investing entirely in one market but would also have achieved this with less volatility. This lower volatility is due to the diversification benefit of investing in two markets that do not perfectly move in sync. When one market underperforms, the other might outperform, helping to balance the portfolio.

My ETF pick

Now, how can Canadian investors capture this diversification benefit? One straightforward way is through an ETF that tracks the S&P 500, such as Vanguard S&P 500 Index ETF (TSX:VFV), which charges a low 0.09% expense ratio.

To sum up, diversification, both in terms of geography and sectors, can be a powerful tool in your investment strategy. By not ignoring the American market, Canadian investors can take advantage of the cyclical performance of the U.S. and Canadian markets to potentially enhance returns and reduce portfolio volatility. So, go ahead and capture the American advantage!

That being said, remember that investing is a long-term game. Although the historical data shows the benefits of a 50/50 split, this doesn’t guarantee future performance. Always consider your financial goals, risk tolerance, and investment horizon before making any investment decisions.