As the economy absorbs the new reality of higher interest rates, the road ahead will be bumpy. That’s not to say that we won’t have any success stories. But, I think the downside will continue to rear its ugly head. Thus, it’s a good idea to prepare for a possible market crash.

Stock market crashes frequently follow large increases in interest rates

The logic is pretty straightforward. Higher rates mean a higher cost of capital. This means it becomes more expensive for companies to grow their businesses. It also means that consumers cannot spend as freely due to a higher cost of lending. In the end, all of this hurts economic growth rates, because companies are not able to grow as quickly, and consumer spending falls. And with the added expense of higher interest, this just worsens the problems and stocks are more likely to fall.

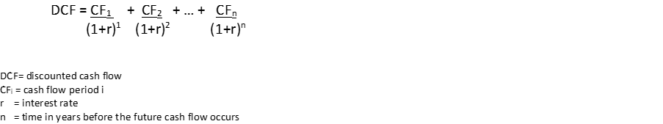

In addition, higher interest rates mean that expected future cash flows are discounted using a higher interest rate. You can find the formula to value stocks based on discounted cash flows below. From it, we can see that the higher the interest rate, or the denominator, the lower the discounted cash flow, and hence, the value.

Diversify into more defensive stocks

With this backdrop, let’s discuss stocks that will hedge against high rates. While all stocks will suffer from the valuation hit that comes with higher interest rates, some are less vulnerable.

For example, gold has long been considered a safe haven, as it’s a good store of value. What this means is that it holds its value well. This is generally true, even in difficult geopolitical and economic times, when most asset values fall significantly and the market crashes.

Agnico-Eagle Mines Ltd. (TSX:AEM) is a high quality, safe, and predictable gold company. But the reasons that I like Agnico-Eagle stock go far beyond the fact that it’s a gold company, with exposure to this safe haven commodity. For starters, Agnico has leading positions in the best mining jurisdictions. These are jurisdictions with low political and economic risk, such as North America and Europe. Also, Agnico continues to post strong, better-than-expected results, driven by growing production and solid performance on the cost side of things. This has all culminated in the company beating expectations in the last six quarters. In the first six months of 2023, cash from operations increased 20% to $1.3 billion

Moving on to the company’s balance sheet, it remains strong, with $433 million in cash, net debt of $1.5 billion, and liquidity of $2.1 billion. Finally, Agnico has paid dividends for 30 consecutive years, and today, the stock is yielding a respectable 3.3%.

Fortis: A utility stock for protection from a market crash

As a $29 billion utility giant with a diverse geographic footprint and asset mix, Fortis Inc. (TSX:FTS) is the epitome of defensive and reliable. In fact, this is reflected in Fortis’ dividend track record of 49 years of consistent dividend growth. It’s also reflected in Fortis’ steady performance and predictable financial results.

And despite the worsening fundamentals of the economy, true to form, Fortis continues to chug along nicely. In the last six months, adjusted net earnings are up 12.6% and EPS is up 14.2%. Also, the company’s cash from operations is up 18% to $1.9 billion.

Looking ahead, Fortis continues to invest in its system, with $4.3 billion worth of capital planned for this year. This money will be spent on projects such as Advanced Metering Infrastructure, which will bolster the safety, resiliency, and efficiency of the gas distribution system. Longer-term, LNG projects and clean energy infrastructure projects will help set Fortis up for growth for many years to come.

Fortis’ management is targeting a 4% to 6% dividend growth rate through 2027.