Artificial intelligence (AI) has been on a meteoric rise in 2023, experiencing a massive bull run that seems unstoppable.

This surge has been catalyzed by multiple factors: the release of revolutionary AI technologies like ChatGPT, record-breaking profits from U.S. chipmakers who power these AI systems, and substantial investments into AI by tech juggernauts.

However, while it may just be my inner pessimist speaking, I’m always wary of getting swept away by market euphoria and the latest “new paradigm!” being extolled by industry pundits and analysts.

History has shown that speculative bubbles form when an asset’s price far exceeds its intrinsic value, often driven by a collective enthusiasm that obscures the risks involved.

Today, I’ll explain why I personally have reservations about jumping headfirst into AI stocks right now, even amid the compelling growth narratives.

I’ll also outline an alternative investment option that offers a balance between risk and reward, providing what I consider a safer pathway in the volatile landscape of emerging technologies.

Why I don’t invest in AI

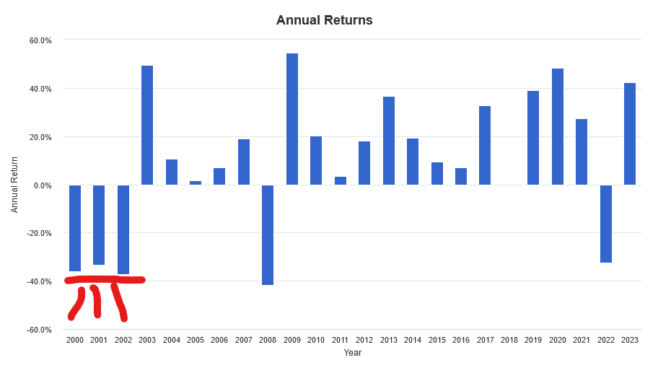

The phrase “history doesn’t repeat itself, but it often rhymes” comes to mind when contemplating the seemingly unstoppable rise of AI stocks. One needn’t look far back to find a cautionary tale; consider the 2000 dot-com bubble.

The optimism surrounding emerging internet companies at the time led to inflated valuations, only for many of these budding businesses to collapse. As a result, the Nasdaq-100 index experienced three consecutive years losses after the bubble burst.

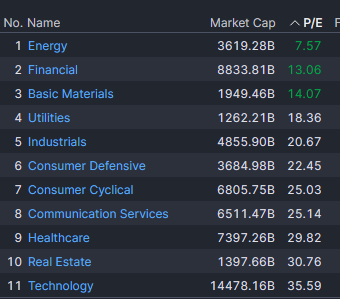

Another crucial point to consider is the matter of valuations. As of now, according to Finviz, the technology sector in the U.S., where most AI companies reside, is trading at a hefty price-to-earnings (P/E) ratio of 35.6. To put this into perspective, compare it to the energy sector, which currently trades at a much more modest P/E of 7.57.

High valuations, while indicative of investor optimism, also imply higher expectations for future growth and performance. Essentially, when you invest in a sector with a high P/E, you’re paying a premium for future earnings, thereby limiting your potential upside. On the flip side, sectors with lower valuations generally offer more room for growth and less downside risk.

So, even if the technology and AI sectors continue to grow, the lofty valuations today could mean more modest returns in the future, particularly when compared to other sectors that are trading at more reasonable multiples.

What I would buy instead of AI stocks

In my humble opinion, today’s fervour around AI technologies is eerily reminiscent of past market frenzies. There’s a general sense of irrational exuberance, with investors often overlooking traditional valuation metrics in favour of nebulous potential.

While AI is undoubtedly transformative, not every company leveraging the technology will emerge as a winner. Therefore, I would rather make a more diversified investment by betting on the overall U.S. market.

Identifying the winning AI stocks of tomorrow is nearly impossible, but by buying the broad U.S. stock market, I’m guaranteed to benefit from their outperformance. I’ll also get a more even balance of sectors.

For a diversified bet on the U.S. stock market, I like BMO S&P 500 Index ETF (TSX:ZSP). This no-frills exchange-traded fund charges a low expense ratio of 0.09%, or around $9 in fees annually on a $10,000 investment.