In the world of dividend investing, proponents often find themselves divided into two distinct camps.

On one side of the spectrum are the “high yield” enthusiasts — individuals who are drawn to stocks currently dishing out above-average dividends. They cherish the immediate gratification of a robust income stream and often prioritize present yield over future potential.

On the opposite end are the “‘growth” aficionados. These investors have a more forward-looking approach, zeroing in on companies that may not pay the highest dividends now but have showcased a knack for consistently growing dividends at a rate that’s better than most.

So, amid these two approaches, which reigns supreme? The honest answer is, it depends. Investing strategies are rarely one size fits all, and the ideal choice often aligns with individual financial goals, risk tolerance, and investment horizons.

To bring clarity to this debate, let’s delve into a comparative illustration using two exchange-traded funds (ETFs): one that champions high yield and another that champions dividend growth.

A tale of two ETFs

We’re pitting iShares S&P/TSX Composite High Dividend Index ETF (TSX:XEI) against iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSX:CDZ).

XEI’s index is fairly straightforward: it screens for Canadian stocks that are currently paying above-average dividend yields. However, CDZ only holds Canadian stocks that have increased dividends for at least five consecutive years.

As of October 5, 2023, XEI is paying a 12-month trailing yield of 5.57%, while CDZ lags it at 4.40%.

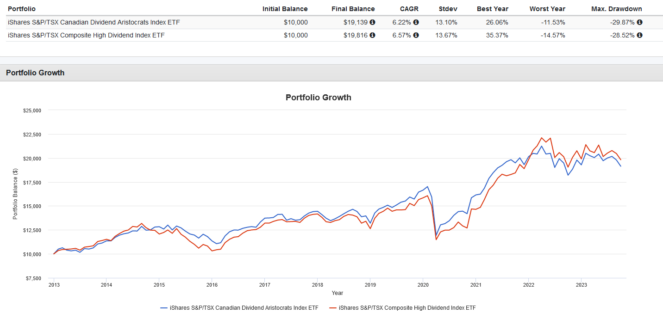

However, in terms of their historical performance from 2013 to September 30, 2023, both ETFs are neck and neck, with XEI returning 6.57% with dividends reinvested perfectly, while CDZ returned 6.22%.

However, keep in mind that CDZ’s higher expense ratio of 0.66% likely ate into its returns significantly, compared to XEI, which charges 0.22%.

The devil is in the details

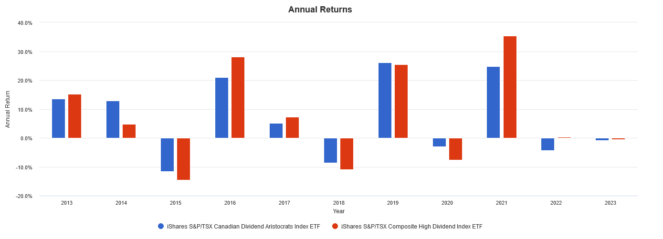

By looking at both ETFs’ annual returns per year, we can see that they don’t always perform the same. Sometimes XEI shines, while other times, CDZ pulls ahead.

Therefore, investors can get the best of both worlds by splitting it 50/50. By doing so, you won’t miss out on the potential of either high-yielding dividend stocks or dividend growth stocks. Choosing between XEI and CDZ doesn’t have to be a one-or-the-other approach.

For further diversification, consider augmenting a high dividend yield or dividend growth strategy with some growth stocks (and the Fool has some great suggestions down below).