When traditional investments like stocks and bonds take a hit, savvy investors often look for alternatives to diversify their portfolios.

Today, we’re shining a spotlight on a unique breed of investments: alternative exchange-traded funds (ETFs). Think of them as akin to hedge funds, with the key difference being their availability to everyday investors through regular trading on stock exchanges.

The charm of these alternative ETFs lies in their potential to maintain a low correlation, with the standard movements of stocks and bonds.

This means they don’t necessarily follow the broader market’s peaks and valleys. They aim for what’s known as positive absolute returns—seeking to make money regardless of whether markets are bullish or bearish.

One such fund that has been gaining attention is the Picton Mahoney Fortified Market Neutral Alternative Fund (TSX:PFMN). Here’s all you need to know about how it works.

PFMN objectives and strategy

Imagine a ship designed to remain steady and afloat even when the sea is choppy. That’s what PFMN is designed to do in the investment world.

This fund takes a unique approach to investing by balancing its positions in the market. First, the fund goes “long” on some stocks, which means it buys shares with the expectation that their value will go up.

At the same time, it also takes “short” positions. To short a stock is to borrow shares and sell them, betting that you can buy them back later at a lower price, return them to the lender, and pocket the difference.

This strategy isn’t confined to just Canadian stocks; it also applies to U.S. equities, spreading out the risk and opportunity across a broader landscape.

The current net exposure of 17.38% as of November 3rd suggests that after accounting for the shorts, the fund still has a modest overall positive exposure to the market—like having a slight tilt towards believing that the value of its investments will go up.

What’s really fascinating about PFMN is that it strives for a market beta of zero. Beta is a measure of how much an investment’s price moves in relation to the market.

A beta of zero means that theoretically, the fund’s value shouldn’t rise or fall just because the market does. In other words, it aims to sail its own course, unaffected by the waves of the stock market.

PFMN performance and fees

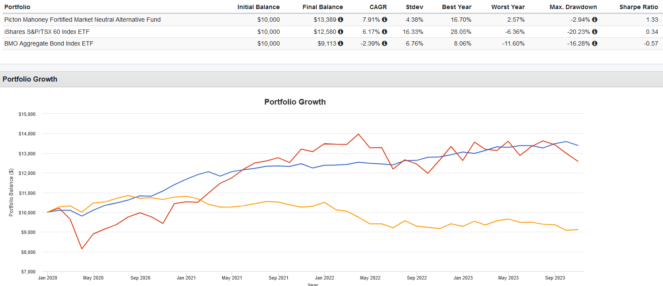

PFMN has been something of a star performer since 2020. It’s managed to outdo both the Canadian stock and bond markets in terms of net returns. But what’s even more impressive is how it’s done this with a lower standard deviation and drawdown.

When we say that PFMN has a lower “standard deviation” compared to other markets, we’re saying that its returns don’t swing wildly—it’s more stable and predictable. The “drawdown” is the peak-to-trough decline during a specific record period of an investment, fund, or commodity. A lower drawdown indicates that there’s less risk of experiencing large losses.

So, essentially, PFMN has been giving investors more bang for their buck—better returns for less risk—and a smoother investing journey with fewer ups and downs.

However, it’s crucial to consider the cost of investing in such a fund. First, PFMN charges a management fee of 0.95%, which is a bit on the higher side.

More noteworthy is the performance fee of 20%. This means that the fund takes 20% of any returns that exceed a certain benchmark, known as the “hurdle rate.” The hurdle rate for PFMN is set at 2%, which means the fund must achieve returns of more than 2% before the performance fee kicks in.

While a performance fee can align the fund manager’s interests with those of the investors (since the fund manager only gets rewarded for outstanding performance), it can also take a significant bite out of your returns.

Therefore, it’s important for an investor to weigh these potential fees against the expected benefits of the fund’s strategy when deciding whether to invest.