Rising interest rates in Canada have put a damper on economic growth and consumer spending. They’ve hit all companies in all industries in one way or another. But there is a silver lining – if you’re a retiree, that is.

Let’s explore the collateral damage and opportunities.

Retirees: You’re in the right place at the right time

I’ll get into some of the negative consequences of the Bank of Canada raising interest rates later. For now, I’d like to focus on retirees, and the wonderful consequence that affects you most directly – higher interest income.

Usually, retirees are past the high-debt years of their lives. For example, mortgages have been paid off, and as the big spending years are in the rear-view mirror, all other types of debt are either also paid off entirely or in part. This leaves retirees well positioned to fully reap the rewards of higher interest rates.

For years, the biggest problem that retirees had was finding a reasonable interest rate on fixed income investments. Because while you should definitely always reserve a portion of your portfolio for equities, fixed income investments at this stage are crucial.

Thankfully, now you can actually earn a decent rate on a guaranteed investment certificate (GIC), for example. It’s a 100% safe, no-risk investment that’s now yielding north of 5% at most Canadian banks. This is a far cry from the yields of well below 2% not too long ago.

Higher rates in action

To illustrate the difference this makes, I would like to go through a quick example. Suppose that you have $100,000 in retirement savings invested in GICs. If we assume they are yielding 1.8%, you would receive $1,800 in annual interest income. Now let’s assume they’re yielding 5%. In this case, you would receive $5,000 in annual income. If you have $500,000 invested in a 5% GIC, your annual income would be $25,000 (versus $9,000 at 1.8%).

As you can see, this is game-changing.

Beware of stock market volatility as rates increase

Contrary to the positive effect that rising interest rates have on interest earned on fixed income investments such as GICs and bonds, they have a negative effect on stock markets. This is because they result in lower economic growth but also because of the present value of money.

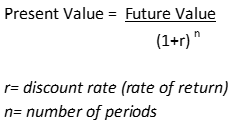

Stocks are valued based on the present value of future cash flows. The formula is as follows:

As you can see, as the interest rate, or r, increases, the present value will decrease. This means that stocks will decline in value. This is the theory. And in practice it does work out this way, in general.

As a retiree, try to stick with those stocks that have growing dividends, defensive businesses, and solid balance sheets to weather the storm of rising rates. This will minimize your downside, yet still leave you exposed to dividend income, dividend growth, and finally capital appreciation when the stock price comes back.

A good example of this type of stock is Fortis Inc. (TSX:FTS). I’ve written a lot about Fortis stock, as this is a stock with a 50-year history of dividend growth and shareholder value creation. It’s also a stock that has been quite predicable over time. Its utility businesses, which are regulated, essentially guarantee this.

Fortis’ latest quarter was another very strong one, coming in ahead of expectations and showing healthy growth. In fact, adjusted EPS increased 18% to $0.84 and operating cash flow of $940 million was up 48%. This result was ahead of expectations that were calling for EPS of $0.81.

These are the types of stocks to be invested in at times of rising interest rates. They are the ones that will be good preservers of your capital.

The bottom line

Canadian retirees are in the sweet spot right now. Take advantage of the Bank of Canada’s higher interest rates by nabbing some attractive bond yields. But also, remain invested in the stock market. Do this by focusing your holdings on strong and safe stocks like Fortis.