It’s always a worthwhile exercise to revisit and re-evaluate our opinion on any given stock. Shopify Inc. (TSX:SHOP) stock is a great candidate for this exercise today. So far in 2023, Shopify’s stock price has almost doubled as the business has continued to escape the downturn in consumer spending and macro economic troubles of the day. But is Shopify still a buy after this sharp move higher?

Let’s explore.

Shopify – the business

I’d like to kick off this article by reviewing some statistics that point to Shopify’s success and scale. Shopify is increasingly present in every facet of commerce, from online to in-person, retail to wholesale, domestic to international. It’s a big pie, and Shopify is gaining more and more of it.

Gross merchant volume, or GMV, increased 22% in the company’s latest quarter, to $56.2 billion. Also, revenue increased 25% to $1.7 billion, and gross profit increased 36% to $901 million.

But there’s more. As you know, Shopify recently transformed into a cash flow positive business. This was a landmark achievement, as the company had to suffer through many years of cash burn and net losses. The transition to a cash flow positive business is by no means guaranteed.

So, this quarter was the fourth consecutive quarter of positive free cash flow for Shopify. This further reinforces the notion that Shopify is now a self-sustaining business, worthy of a higher valuation and a lower risk profile. In fact, the company’s free cash flow margin was a very healthy 16% in the latest quarter.

Valuation on SHOP stock is high

Shopify is well-known as Canada’s leader in the world of e-commerce. Grown out of the possibilities of the internet and entrepreneurs, Shopify has catapulted many towards a life of empowerment. Revenue has been soaring and the momentum is strong. So, it’s no surprise that the e-commerce world has been catapulted into greatness by Shopify stock. And investors have come along for the ride.

Accordingly, analysts have recently increased their target prices on Shopify stock. Yet, these analysts seem to be largely chasing the stock higher, likely due to concerns with regard to the stock’s valuation. In fact, it appears that the stock is now an “investor darling” that’s priced for perfection. But a little skepticism is always good.

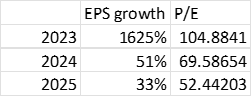

The chart below highlights Shopify’s expected earnings growth relative to its valuation.

As you can see, Shopify’s stock price currently trades at 104 times 2023 expected earnings. Looking ahead, Shopify stock trades at 70 times 2024 expected EPS and 52 times 2025 expected EPS, with corresponding growth rates of 51% and 33% respectively. Clearly, Shopify stock is reflecting the highest of expectations. The excitement is understandable, but I don’t think buying at these times is the best idea.

The bottom line

My recommendation for those investors who are interested in SHOP stock is to stay on the sidelines for now. I think there will be a better entry point that you can get in without risking too much downside. The stock is up 490% in the last five years, but it has fallen 38% in the last three years. With a stock this volatile, when you buy matters. As we can see, those who bought at the highs of 2022 are under water.

In my view, Shopify stock is vulnerable here. It’s lofty valuation and its consumer focus are not well-suited for the precarious macro-economic environment that we currently find ourselves in. Higher interest rates for longer will have a negative effect on both consumer spending and valuation.