Tax-Free Saving Account (TFSA) investors have a great opportunity to benefit from passive-income streams. These income streams are tax-free within the TFSA, and they’re an easy way to get ahead in this increasingly uncertain and precarious environment. Today, the TFSA contribution limit is $95,000, leaving us plenty of room to generate pretty significant passive-income streams.

The market continues to hold its own despite increasing recession fears, higher interest rates, and inflation. In fact, the TSX is 21% higher than its 2019 close. This is a fact that is surprising to me, and one that motivates me to prepare for potential downside. Dividend stocks that provide generous passive-income streams are an ideal way to do this.

Here are two proven dividend stocks to generate passive income in your TFSA.

BCE: A top TFSA stock for passive income

With 40 years of dividend payments under its belt and a 5% or higher dividend increase in the last 15 years, BCE (TSX:BCE) has an enviable dividend track record. This is made possible by its leading position in the telecommunications industry and its solid operational and financial performance.

In fact, in the first nine months of 2023, BCE reported cash flow from operations of $5.6 billion. It also generated free cash flow of $1.8 billion, which translates to a healthy 10% of revenue. This is all backed by a business that’s relatively steady and predictable, with ample cash flows and a strong competitive position. All of these things ensure dividend reliability and consistency.

BCE yields a very generous 7.5% at this time, ensuring significant TFSA passive income for years to come.

Enbridge

As one of Canada’s leading energy infrastructure companies, Enbridge (TSX:ENB) needs no introduction. What it does need, however, is for me to highlight the strength of its business, and its record of strong shareholder returns. This is what makes it a strong option for TFSA investors looking for passive income.

Did you know that Enbridge has 29 consecutive years of dividend increases under its belt? And did you know that Enbridge’s cash flows and revenue are highly predictable and stable over time? Let me explain.

Since the year 2000, Enbridge’s annual dividend per share has increased over 1,000% to the current $3.66. That’s a very healthy 11% compound annual growth rate (CAGR). And this is backed by consistent and reliable cash flows.

Enbridge’s cash flow profile is diversified across its different businesses. Also, 98% of the company’s EBITDA is underpinned by long-term contracts or “take or pay” contracts (with the added feature of inflation protection and cost-sharing provisions). Finally, Enbridge’s recent acquisition of three U.S. utilities provides more stable, reliable revenue and cash flows to the company.

Enbridge is yielding a very attractive 7.7% for plenty of TFSA passive income.

The numbers

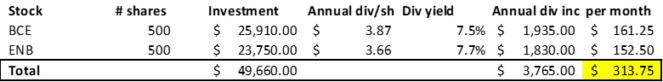

As you can see from the chart below, investing a little more than half of your TFSA contribution limit, $49,660, into these two stocks will generate $3,765 in annual dividend income, or $313.75 in monthly income.

This is a pretty secure and reliable income that’s backed by two of the most proven dividend payors on the market. Looking ahead, both of these businesses have positive outlooks, as they remain entrenched in their favourable competitive positions in these core and essential industries.