Canadian dividend investing often splits investors into two camps. There are those who chase high-yield dividend stocks, attracted by the immediate income these stocks promise.

In contrast, other investors lean towards stocks that consistently grow their dividends. This group values the potential for long-term gains, betting on the snowball effect of gradually increasing payouts.

Now, the question of which approach is better isn’t straightforward and might yield a surprising answer. Stay tuned to explore the pros and cons of each strategy and how to find the right balance in your dividend investment approach.

High-yield dividend stocks

There’s no universally accepted definition that precisely outlines what qualifies a stock as “high yield.” Generally, a high-yield stock is characterized by offering a dividend yield that surpasses the average yield of its sector peers or the broader geographic market in which it operates.

For example, to determine if a Canadian pipeline company is a high-yield stock, one would compare its yield against the aggregate yield of the Canadian energy sector and the S&P/TSX 60 Index.

A key aspect of high-yield stocks is their payout ratio, an important metric for investors to monitor. The payout ratio is the proportion of earnings a company pays to shareholders in the form of dividends.

A high payout ratio can indicate that a company is returning a significant portion of its earnings to shareholders, which is attractive for those seeking immediate income.

However, a very high payout ratio can also be a red flag. It might suggest that the company is paying out more in dividends than it can afford, which could be unsustainable in the long term.

This situation could lead to future dividend cuts if the company faces financial challenges or needs to reinvest more of its earnings back into the business. Therefore, while high-yield stocks can offer attractive immediate returns, it’s crucial for investors to assess the sustainability of these dividends.

Dividend-growth stocks

Dividend-growth stocks represent a different approach to dividend investing, prioritizing consistent increases over time rather than high, immediate yields.

These stocks may not offer the highest yields initially, but they stand out for their ability to increase dividends year over year at a rate faster than their peers or for maintaining an unbroken streak of dividend growth over a number of years.

Side note: in Canada, for a stock to qualify as a Dividend Aristocrat, it needs to have a history of increasing its dividends for at least five consecutive years.

Now, the true underlying strength of dividend growth stocks often lies in their fundamentals. These companies typically exhibit characteristics such as high free cash flow, which indicates their ability to generate enough cash to sustain and grow dividends.

A high return on equity (ROE) is another positive sign, suggesting that the company is efficiently generating profits from its equity. Additionally, wide net profit margins indicate a healthy level of profitability, further supporting the company’s ability to increase dividends.

Dividend growth vs. high-yield dividend

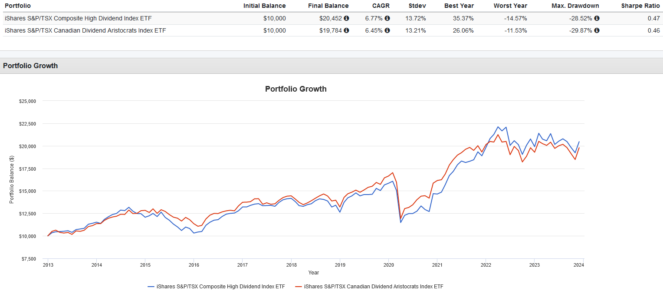

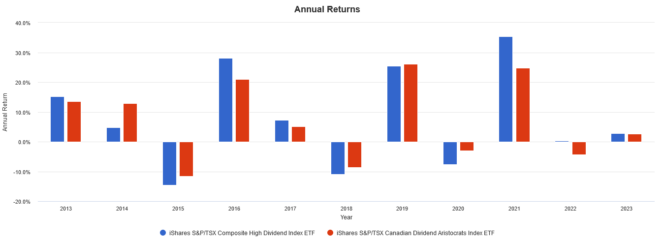

Funny enough, comparing iShares S&P/TSX Composite High Dividend Index ETF (TSX:XEI) versus the iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSX:CDZ) shows that from 2013 to present, both exchange-traded funds (ETFs) are neck and neck in terms of total returns (i.e., with dividends reinvested).

In some years, XEI does better, while in others, CDZ pulls ahead. There’s no real discernible pattern. Remember, these results are with all dividends reinvested perfectly.

The lesson here? Don’t fret too much about picking between high-yield dividend or dividend-growth stocks. Pick one or split the difference, but above all, stay the course, reinvest dividends, and be patient.