Do you want to claim Canada Pension Plan (CPP) benefits when you turn 60?

If so, congratulations! You’re average!

According to research by Owen Winkelmolen, 60 was the most common age for Canadians to take CPP at in 2018, with 38% of Canadians choosing to take benefits at that age. Winkelmolen’s data table shows that 65 was the second-most common age for Canadians to take CPP at, with ages in the 61-64 band being fairly common, and ages 66 and beyond being very uncommon. The mean age to take CPP at, based on Winkelmolen’s data, would appear to be something like 62. The mode — another type of average — was 60.

So, taking CPP in one’s early 60s is a very popular choice. Unfortunately, it’s not always a good one. Taking CPP early only makes sense if your life expectancy is lower than average, or if for some reason, you absolutely have to stop working before age 65. Absent these conditions, you really ought to wait until age 65 to take CPP benefits.

Taking CPP at 60 results in the least amount of benefits for Canadians with average life expectancies

The average life expectancy in Canada is 81.75 years. If you have indications from your doctor that you are about as healthy as the average Canadian, you can probably safely delay taking CPP well past the age of 60.

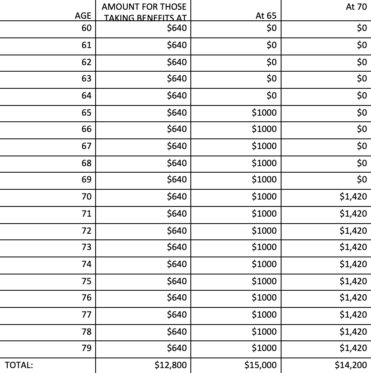

The table below shows how much total benefits Canadians get from CPP, taking benefits at 60, 65 and 70 (ignoring the effects of CPI indexing). As you can see, taking benefits at 65 results in the greatest total benefits by age 79. Interestingly enough, this would seem to imply that you should not delay taking benefits for the longest possible time if you are average. But it certainly beats taking benefits at 60 for most people.

Here’s when you should take CPP at 60 anyway

Regardless of all the aforementioned points, you should take CPP at 60 if you have urgent health needs or simply can’t work. If you can no longer work right now, then you need all the passive income you can get. Taking CPP benefits early is one way to get such income very soon.

How to generate passive income when not taking CPP benefits

If you have decided that you will delay taking CPP past the age of 60, you’ve likely made the right choice. If you’re still able to work, it makes sense to delay until age 65. However, you may still enjoy the feeling of passive income while you’re working. If so, investing in dividend stocks may make sense.

Consider Toronto-Dominion Bank (TSX:TD), for example. It’s a Canadian bank stock with a 4.92% dividend yield. This means that if the dividend does not change, then you’ll get $4,920 in passive income per year by investing $100,000 into it.

Historically, TD’s dividend yield has changed. Over the last five years, it has risen by 8% compound annual growth rate! If the past looks like the future, then you will get not just $4,920 per year by investing in it, but an ever-rising amount that starts at $4,920. Unfortunately, TD Bank’s earnings declined last quarter, and the company is at risk of being fined by the U.S. Department of Justice. I reduced my holdings in TD Bank for these reasons — reasons that argue for further dividend hikes not being management’s best choice. Still, TD is a sensible dividend stock to hold today.