Should you take the Canada Pension Plan (CPP) at age 70? Some would say that it’s far too long to wait to get your pension money, but the benefits accruing to those who go the mile are well worth it.

As I showed in previous articles on this topic, you can get much more CPP benefits than you’d normally receive by waiting longer to take them. CPP benefits are reduced by 7.2% per year for each year prior to age 65. They are increased by 8.4% for each year past age 65. In this article, I will explore in detail how much money you’ll receive if you delay taking CPP for the longest amount of time possible.

Image source: Getty Images

CPP at Age 70: $1,079

You get the highest amount of CPP benefits if you delay taking them until age 70. At this age, the average amount is $1,079 per month, and the maximum amount is $1,855 per month. If your goal is to maximize your annual benefits, or if you expect to live a very long life, then 70 is the best age at which to begin taking CPP.

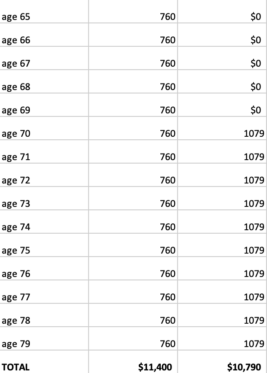

Funnily enough, though, 70 isn’t always the age that maximizes lifetime CPP benefits. You get more over a 15-year period starting at age 65 than you do over a 10-year period starting at 70. The end of these 10 and 15-year periods coincides with the average life expectancy in Canada (about 80 years). So, unless you believe you’ll live a longer than average life, 65 might be the best age for you to take benefits. See the table below if you don’t believe me!

Not satisfied with the amount of CPP money you’re likely to get? Why not invest?

If you aren’t satisfied with the amount of CPP you’re likely to get by delaying your benefits all the way to age 70, then you should consider investing to supplement your pension income. Investing is a very popular way to boost your wealth because it produces cash flows (dividends, interest) that come in on a regular basis.

Consider Toronto-Dominion Bank (TSX:TD), for example. It’s a Canadian bank stock that offers a very generous 4.7% dividend yield. The company’s stock got beaten down last year because one of its deals got cancelled, resulting in the bank incurring costly cancellation fees. Also, the stock took a bit of a beating in the spring 2023 banking crisis, which created concerns about the entire banking sector. Those concerns have mostly abated, and TD has the go-ahead to perform better in future quarters. However, thanks to the selloff in its shares, it can now be bought at a high yield, which can generate a lot of passive income.

Foolish takeaway

The decision about when to take your CPP benefits is one of the hardest you’ll ever face. The variables you have to consider to make the decision are numerous. Truthfully, you’ll want to talk to a financial adviser and an accountant about it. Hopefully, I shared enough information in this article to point you in the right direction.