Canadian National Railway (TSX:CNR), or CN stock, has been a great long-term investment, generating impressive returns for shareholders since going public in 1995. But can it help you retire a millionaire? This post will explore that question.

How much could a CNR stock investment have generated in the past? Hypothetically, individual investors who bought $10,000 worth of CN stock at its initial public offering and reinvested all dividends would have about $1.28 million in their accounts today. They could be retiring as millionaires this year. Investing the same capital in an S&P/TSX Composite Index exchange-traded fund could have grown capital to about $70,000.

That said, historical performance isn’t a predictor of future investment returns. Regardless, the railroad stock deserves consideration in a retirement portfolio.

Canadian National Railway stock: A resilient wealth-creation machine

Since its founding in 1919, the Canadian National Railway has retained all the qualities that make it an attractive long-term investment. It operates in a naturally monopolistic industry where large capital outlays and tight regulation ward off new competition. Two large players operate railway lines across Canada.

The Canadian duopoly of CN and Canadian Pacific Kansas City is likely to exist throughout our lifetimes. Operating efficiency gains from scientific management approaches (including precision scheduling railroading) help to sustain healthy operating margins.

Although the large-cap stock’s operating margins may gyrate with economic cycles, CN continues to generate positive and predictable free cash flow year in and year out.

Cash flow is king at CNR stock

Legendary investor Warren Buffett loves rail road companies mostly for their cash flow-generating power. Free cash flow is the residual cash from operating activities after deducting capital expenditures. Cash flow is a valuable resource that CN internally creates to unlock sustainable returns to shareholders.

The company continued to generate positive free cash flows during weak operating regimes of 2022 and 2023, characterized by inflationary pressures, labour strife, and disruptive wildfires. Free cash flow doubled from $2 billion in 2019 to $4.1 billion in 2021, and the company generated $3.7 billion in free cash flow over the past 12 months.

Internally generated cash flows help finance efficiency improvements, fund accretive acquisitions, and grow dividends to shareholders. Most noteworthy, positive free cash flow can sustain CNR’s share repurchases to prop up its share price.

The company has reduced its average diluted shares outstanding by 27.8% since 1995. Fewer shares reduce the total claims on future profits and cash flow by the investing community. Each remaining share unit is thus entitled to a higher share of assets, residual earnings, and cash flow. Each share will be worth more after each round of share repurchases.

Can CNR stock make you a millionaire?

CNR is a slow-and-steady growth stock that can form part of an individual’s core portfolio and help one become a millionaire. However, patience is key. Retiring a millionaire on stock investments generally requires a lot of diligence and consistency, and patience will be your best friend. Early investors who turned $10,000 on CNR stock into a million had to wait for nearly 30 years.

Investors with fairly long investment horizons could realize positive returns on the railroad stock. One can steadily build sizeable positions in the railroad operator during their active working life and retire with a significant portfolio size.

The notable risks on CNR stock today have largely to do with the North American economy’s health and performance during an investor’s holding period. A poor North American economy will demand fewer railway cars to move it, reduce railroad companies’ cake, shrink their operating and cash flow margins, and compress their valuation multiples.

Time to buy?

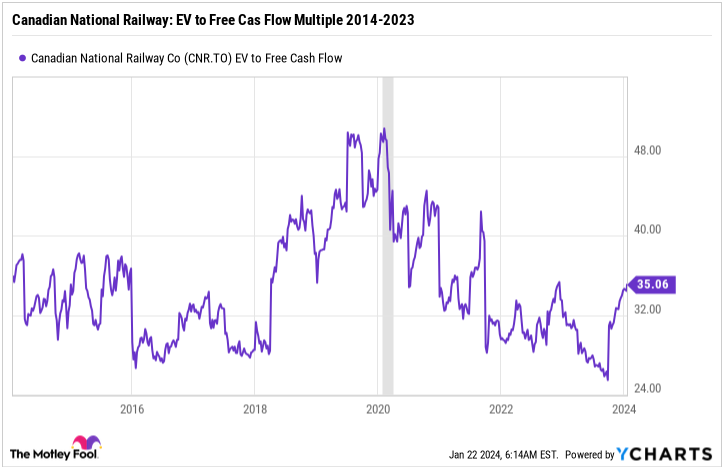

CNR stock remains a good buy now, despite a recent 18% rally during the past three months. The company trades at a fair cash flow multiple compared to its historical multiples. Its enterprise value to free cash flow multiple of 35 is well within a historical 10-year range of 25 to 50.

Bay Street analysts project a 5.9% average annual growth in CN’s earnings over the next five years. Combined with a 1.9% dividend yield and high single-digit dividend growth, it’s not a big ask to expect a 6-9% average annual return on CNR stock going forward.