Large-cap stocks can rule nascent industry waves. The “Magnificent Seven,” a group of seven U.S. technology mega-cap stocks, could reap the most profit from massive generative artificial intelligence (AI) adoption. Their deep wallets, treasure troves of customer data, and leading human expertise allow them to take charge of bringing AI to billions of consumers. Most of the Magnificent Seven stocks are riding the generative AI wave to new heights in 2024.

Who are the “Magnificent Seven,” and why are they top-performing AI stocks?

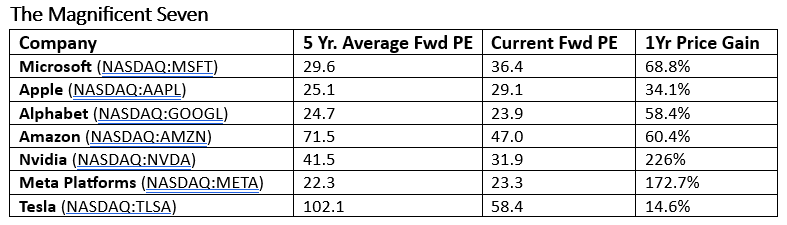

The Magnificent Seven include leading tech giants Microsoft, Apple, Alphabet, Amazon.com, Nvidia, the leading AI computing hardware supplier that enjoyed monopoly in 2023, propelling its stock into the trillion-dollar league for the first time, Meta Platforms, and Tesla stock.

All seven mega-companies are deeply involved in AI development and marketing. Subsequent to rallies in 2023, some AI stocks may appear expensively priced relative to their historical normalized forward earnings multiples. However, wild growth expectations make Nvidia and Amazon stocks cheaper.

One could argue that Tesla stock shouldn’t be deep in the AI running today, unless its founder’s “demands” for a 25% voting power as a precondition for growing Tesla into an AI and robotics leader are met or resolved.

Below are four smaller top AI stocks that Canadian investors could add to their growth-oriented portfolios.

Advanced Micro Devices (AMD)

Semiconductor designer Advanced Micro Devices (NASDAQ:AMD) should experience significant business upheaval in 2024. The company has ended Nvidia’s AI-chip “monopoly” by rolling out a formidable hardware offering. AMD’s MI300 chipset is an AI accelerator that is cheaper than Nvidia’s pricey offerings yet almost equally as good.

The company’s most advanced AI chipset, the MI300X, started shipping to customers in January. It’s broadening customers’ AI hardware choices. The new hardware could do the heavy lifting in propelling AMD’s revenue and earnings growth this year. Bullish investors have sent AMD stock 145% higher over the past year to print new all-time highs.

AMD is my top stock to buy and hold for the next five years.

International Business Machines (IBM)

Generative AI could be a strong tailwind propelling and rejuvenating a historically underperforming International Business Machines (NYSE:IBM) back into revenue, earnings, and stock price growth. IBM stock surged by 9.5% to print a new 10-year high after earnings on January 24, as AI offerings propelled the 113-year-old company into a new wave of sales and earnings growth. AI could give IBM a new lease of life.

IBM’s core AI platform, called Watson, helps customers train, deploy, and manage AI models. “Client demand for AI is accelerating, and our book of business for Watsonx and generative AI roughly doubled from the third to the fourth quarter,” IBM chief executive officer (CEO) Arvind Krishna is quoted in the company’s recent fourth-quarter 2023 earnings release.

CGI

CGI (TSX:GIB.A) is a technology and business consultancy firm that saw increased interest in its AI consultancy services as businesses try to adopt generative AI and develop custom AI applications to improve productivity and efficiency. AI-related bookings reached 5% of quarterly revenue by the third quarter of calendar year 2023.

The tech firm’s three-year, $1 billion investment plan, announced in July last year, aims to expand its AI consulting capabilities and accelerate investments in its PulseAI — an intelligent generative AI platform companies can use to deploy intelligent chatbots and virtual assistants. Although client adoption of generative AI is still in its infancy, CGI was already involved in over 600 AI-related active projects by September last year.

Bay Street analysts project CGI could generate a record free cash flow above $2 billion for fiscal year 2025. Accelerated AI bookings could propel earnings growth and cash flow generation beyond current estimates.

Broadcom

Broadcom (NASDAQ:AVGO) is another leading semiconductor designer that announced a networking chip for AI computing in November 2023. The chip improves information movement around AI data centres. Demand could skyrocket, as companies spend billions building new AI-compliant data centres and upgrading old infrastructure to handle increased AI-related task loads.

Broadcom stock has surged by 109% over the past year, expanding its forward price-to-earnings ratio to 26 times 2024 normalized earnings. Shares appear cheaper compared to five of the Magnificent Seven stocks.