Rogers Communications (TSX:RCI.B) stock has significantly underperformed the S&P/TSX Composite Index over the past five and 10-year investment horizons. However, the Canadian telecom market giant’s $20.5 billion takeover of Shaw Communications, which concluded in April 2023, has the potential to be a significant turning point for Rogers stock. The merger could lead to improved stock returns for long-term investors.

According to the company’s latest fourth-quarter (Q4) 2023 financial results, the takeover of Shaw Communications has had a substantial impact on Rogers’s operating profile. This change could affect the investment returns generated by the domestic stock in 2024 and beyond.

Rogers’s operating profile materially improved after Shaw takeover

Rogers Communications took a significant risk by paying a steep 70% value premium for Shaw’s business. However, this takeover has fundamentally changed the company’s business profile.

The deal has resulted in significant improvements in revenue, operating earnings margins, and free cash flow generation. For example, the Shaw takeover has doubled Rogers’s quarterly Cable segment revenue run rate from $1 billion to $2 billion. Just 10 months after the merger, Rogers has achieved industry-leading cable margins of 56% as of December 2023, up from 51% in 2022.

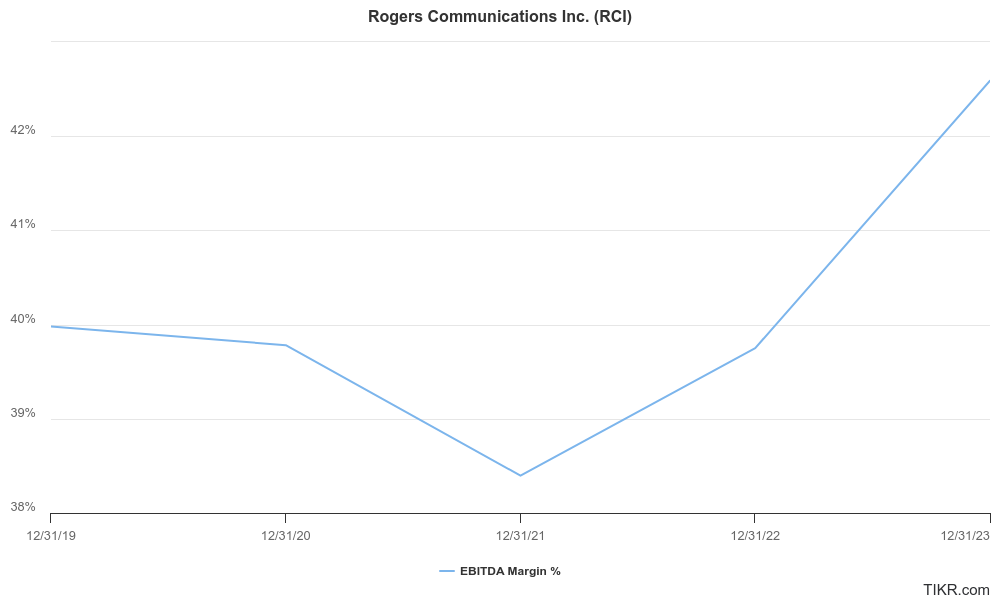

The company’s adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) growth rates have surpassed its revenue growth in the last two quarters of 2023, with service revenue growing 30% and adjusted EBITDA growing by 39%, year over year in Q4. EBITDA margins expanded over the past 12 months.

Additionally, Rogers has realized $375 million (or up to $750 million at an annualized run rate exiting the fourth quarter of 2023) in synergistic cost savings, which has helped boost adjusted earnings margins and free cash flow generation. These cost savings were achieved six months ahead of schedule and were initially expected to exceed $1 billion annually within two years of the merger — before the sale of part of Shaw’s wireless business to Quebecor to gain regulatory approval for the deal.

A significant development following the merger is the company’s accelerated market share gains in Western Canada, which was Shaw’s original territory. Rogers has successfully introduced internet and TV services to customers in this region and is now a coast-to-coast wireless service provider in Canada. These market share gains, along with increased customer signups post-merger, could make the company more profitable and amplify its cash flow generation power.

The company is more operationally profitable now, its market clout has increased, and its cash flow-generation power is amplified.

Should you buy Rogers stock today?

Given noted positive developments, investors may wonder if now is the right time to buy Rogers stock.

After acquiring Shaw Communications’ business, Rogers stock may be a superior Canadian telecom stock tp hold. This is due to the expansion of its adjusted EBITDA margins, the successful execution of promised synergies, and the company’s ability to attract more subscribers.

However, higher debt servicing costs weigh on bottom-line profitability, and some investors may be concerned about the time it will take for leverage to decrease to more comfortable levels. While the company sold its $829 million combined stake in Cogeco and Cogeco Communications in December to reduce leverage, it has more work to do in fully restoring its balance sheet.

That being said, new investors in Rogers stock are purchasing a leading Canadian telecom stock that has a wider reach, higher adjusted EBITDA margins, greater capacity for generating cash flow, and a dividend that is now better covered.

Management’s financial guidance for 2024 predicts revenue growth of up to 10%, adjusted EBITDA growth of up to 15%, and free cash flow between $2.9 billion and $3.1 billion, compared to $2.4 billion in 2023. Shareholders receive a quarterly dividend that yields a respectable 3.2% annually. With growing free cash flow margins, Rogers has better support for its dividend, allowing for potential dividend growth in the future once it has addressed its debt levels.

Investors also have the option to reinvest their quarterly dividends through Rogers’s dividend-reinvestment plan and receive new Class B shares at a 2% discount to market prices.

The main challenge Rogers may face lies within its cable and internet segment, where increased competition from BCE’s fibre-to-home network could result in potential price wars or weaken Rogers’s pricing power.