In the last few years, Enbridge Inc. (TSX:ENB) has become what I would call a super dividend stock. This is because Enbridge stock has been consistently yielding around 8%, while being underpinned by a strong balance sheet and cash flows.

Let’s explore why Enbridge is such an attractive dividend stock, and how many shares you need to generate $1,830 in annual passive income.

Enbridge stock through the years

Five years ago, in 2019, Enbridge stock was trading in the high $40 range – similar to today. At that time, Enbridge’s net income was $5.3 billion. This compares to $5.8 billion in 2023. Also, its cash flow from operations totaled $9.4 billion compared to $14.2 billion in 2023

But let me take you back to the sentiment in 2019. Investors and policy makers had turned sour on everything oil and gas. This made pipeline approvals uncertain at best and slow and difficult at worse. It was all about renewables, and how fossil fuels need to be phased out as soon as possible. This left oil and gas companies like Enbridge struggling for respect.

Since then, the talk and policies have shifted to reflect a more balanced view of the energy transition and the reality that oil and gas are essential, at least for now. Additionally, new ideas and technologies have come forth in an attempt to clean up the fossil fuels industry. Where everything will settle is not perfectly clear, but there’s a more constructive view that has taken hold.

This means that companies like Enbridge are positioned way better today than 5 years ago.

An ideal passive income generator

Now let’s look more specifically at Enbridge’s business and why it’s such a fantastic buy today for passive income. Firstly, Enbridge stock is currently yielding a very generous 7.52%. This yield is attractive for any stock, but it’s especially attractive for a stock like Enbridge. This is because the risk associated with this yield is quite low. A yield like this usually comes with a higher risk profile, but with Enbridge, I see a lot of safety and predictability.

For example, 98% of Enbridge’s earnings before interest, taxes, depreciation, and amortization (EBITDA) is from cost of service or contracted assets. Also, more than 95% of Enbridge’s customers are investment grade. Lastly, 80% of EBITDA is inflation protected. So, you can see here that this results in highly predictable and low risk revenue and cash flows for Enbridge.

This is an ideal stock profile to look for when buying stocks for passive income.

How to generate $1,830/yr from this dividend stock

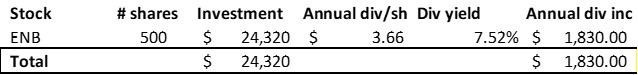

Finally, let’s review how you can go about securing $1,830 in annual passive income from Enbridge stock. As you can see from the table below, buying 500 shares of Enbridge stock will result in annual dividend income of $1,830. Your total investment will be $24,320 at today’s trading price of $48.64.

The bottom line

We can look long and hard for high yield dividend stocks that have this attractive risk/reward profile. But it’s not easy to find because this dynamic doesn’t happen every day. In my view, investors are overstating the risk in Enbridge stock and ignoring a lot. Specifically, consider Enbridge’s utilities acquisition closing in 2024 as well as the reality that in order to continue to live comfortably and grow economically, we still need oil and gas.