Publicly traded real estate has been out of favour since interest rates soared, sending discount rates on property portfolios higher since 2022. However, some property portfolios have very little debt exposure, and their rental rates continue to climb higher. Income-oriented investors could buy stakes in high-quality real estate assets at cheaper prices today at pennies to the dollar and create resilient passive-income streams for a happier retirement.

Dream Industrial Real Estate Investment Trust (TSX:DIR.UN) is an example of a high-quality Canadian REIT to buy for passive income. It trades at a discount to its net asset value (NAV) today, has very little debt on its balance sheet, pays surprisingly low interest rates on existing debt, and may experience further rental income growth in 2024, despite a normalizing industrial property market.

Dream Industrial REIT: A passive-income investment to grab

The Dream Industrial REIT is a $3.5 billion property trust that owns and manages a portfolio of 327 industrial-use properties comprising 71.4 million square feet of gross leasable area (GLA) worth nearly $8 billion located in Canada and Europe, with some investments in the United States. The portfolio’s rental income growth has been spectacular, its cash flow-generation capacity remains strong, and its monthly income distributions (dividends) could be a sustainable passive-income source for decades to come.

The top-performing Canadian industrial REIT has been in a strong growth mode lately, driven by asset acquisitions, development activity, and most importantly, same-property rent growth. After splurging more than $10 billion in acquisitions over the past four years, the trust’s operating revenue grew from $195 million annually in 2019 to $437.6 million in 2023 while portfolio occupancy rates remained strong at 96% going into 2024.

Although a strong rent growth spat in the Canadian industrial property market has been normalizing since last year, Dream Industrial REIT reported same-property net operating income (NOI) growth of 11.3% year over year in 2023. The trust signed new leases at rates 41.6% above expiring rents between October 2023 and January 31 this year. Canadian rent spreads on new leases did the heavy lifting and topped at 50.3% above expiring rates during the period.

Expecting further rent growth in 2024

Dream Industrial REIT’s portfolio may retain its oomph in 2024. Its in-place rents remain largely below market rents today. In a recent investor presentation released last month, market rents were 30% above Dream Industrial REIT’s contracted rates. The portfolio had over four million square feet of maturing leases in Ontario and Quebec in 2024 and 2025, and average market rents in these areas are approximately double the trust’s expiring in-place rates.

Higher rental rates with stable occupancy levels should sustain Dream Industrial REIT’s well-covered monthly distribution for the foreseeable future, even if interest rates remain elevated for longer.

Respectable yield, low leverage, and low interest expense

REITs, by design, are highly leveraged assets because they borrow a lot from mortgage lenders and from unsecured debt markets to fund property acquisitions and developments. Debt ratios may be as high as 60% in the industry, subjecting the REIT asset class to significant pricing pressure as interest rates rise and borrowing costs increase to put a squeeze on funds from operations. However, Dream Industrial REIT is exceptional.

The REIT reported a low debt ratio of 36% going into 2024. It is one of the least indebted property investment trusts on the TSX with a strong balance sheet that retains an investment-grade credit rating.

Notably, a low weighted average face interest rate on the trust’s debt, at 2.35%, could make industry peers envious. It will take years before rising financing costs due to mortgage renewals and new debt issues begin to worry income-oriented investors.

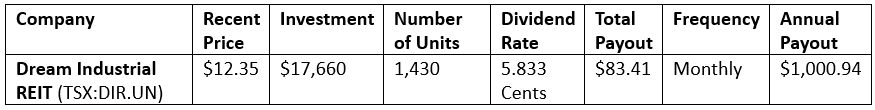

Most noteworthy, the trust’s current monthly distribution of 5.833 cents yields a respectable 5.6% annually. The distribution is well covered by recurring cash flow, and units trade at more than 25% discount to the last report’s net asset value of $16.61 per unit on December 31, 2023.

How to generate $1,000 in passive income

To generate $1,000 in annual passive income, investors may acquire 1,430 Dream Industrial REIT units at current prices and receive monthly distributions, as highlighted in the table below.

Claim Membership Credit

Claim Membership Credit