Dividend stocks are an essential part of any portfolio. Whether you’re already retired or in the early stages of building your wealth, the regular payments from dividend stocks go a long way. So it’s always nice when we can find stocks with high yields to maximize this income, like the ones I’ll discuss in this article.

Without further ado, here are the three dividend stocks that you can rely on to supplement your income no matter what stage of life you’re in.

Enbridge: An 8% dividend yield

As one of Canada’s leading energy infrastructure giants, Enbridge Inc. (TSX:ENB) has been a reliable dividend payor for decades. Today, it’s yielding 8%, with a strong history of dividend growth and reliability.

In fact, Enbridge has a 29-year history of dividend increases. This stellar track record is backed by a low-risk cash profile. It’s what makes the dividend as reliable as it is. For example, 98% of Enbridge’s EBITDA is from cost-of-service or contracted assets. Also, 95% of Enbridge’s customers are investment grade, and 80% of EBITDA has inflation protection. As you can see, the risk associated with Enbridge’s dividend yield is quite low.

Labrador Iron Ore Royalty: A 5.9% dividend yield

The income of Labrador Iron Ore Royalty Corp. (TSX:LIF) is entirely dependent on the Iron Ore Company of Canada (IOC) – Canada’s largest iron ore producer. IOC owns mining leases and licenses covering 18,200 hectares of land near Labrador City, from which Labrador Iron Ore Royalty collects a 7% royalty.

IOC has a strong position in its industry, with a strong quality product that commands a premium. Also, iron ore is used primarily in the production of steel, which is essential to industrial economies. It is for these reasons that we can view Labrador’s dividend as reliable.

In the last five years, Labrador has paid out more than $17 in regular and special dividends.

Telus: A 6.9% dividend yield

Telus Corp. (TSX:T) is a unique telecommunications giant that has a history of solid shareholder returns. Its business model is one that has generated significant cash flow and free cash flow growth. In the five years ended 2023, for example, cash flow grew 14.6% to $4 billion. This equates to a five-year compound annual growth rate (CAGR) of 3%.

This has enabled the company to pay out a significant amount in dividends, and to grow these dividends consistently and reliably. In the last 10 years, Telus’ annual dividend increased at a CAGR of 7.6%, to $1.50.

Looking ahead, Telus’ dividend policy targets semi-annual increases, with the annual increase in the range of 7% to 10% through to the end of 2025.

The numbers

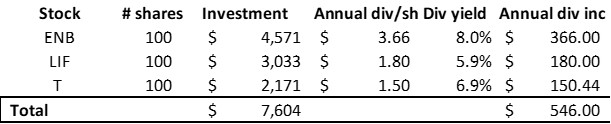

I’ll finish off by summarizing the numbers in a chart (see below).

For $7,600, you can buy 100 shares of each of these stocks. This would give you exposure to these attractive yields and generate $536 in annual dividend income. Given that each of these companies has a strong track record of increasing dividends as well as businesses that are expected to continue to grow, their dividends are not only reliable, but can also be expected to grow over time.