While I don’t personally invest in any specific Canadian stocks listed on the TSX, if I were to venture into that market, I would undoubtedly choose to do so via an exchange-traded fund (ETF).

ETFs offer broad coverage of the market at a remarkably low cost. They provide a simple and efficient way to quickly build a diversified portfolio. Additionally, many ETFs offer the advantage of decent dividend payouts and tax efficiency.

Given the variety of options available, it’s important to choose wisely. My top pick for the smartest TSX ETF to buy right now with $1,000 is BMO S&P/TSX 60 Index ETF (TSX:ZIU). Here’s why.

Why the TSX 60?

The S&P/TSX 60 Index, as its name suggests, tracks the 60 largest publicly listed stocks in Canada.

This selection of stocks includes the country’s foremost banks, railway companies, pipeline operators, as well as major telecom and insurance companies, representing a robust cross-section of Canada’s blue-chip corporations.

In comparison, there are ETFs available that track the S&P/TSX Capped Composite Index. This index includes all the companies from the TSX 60 plus several hundred additional mid and small-cap stocks.

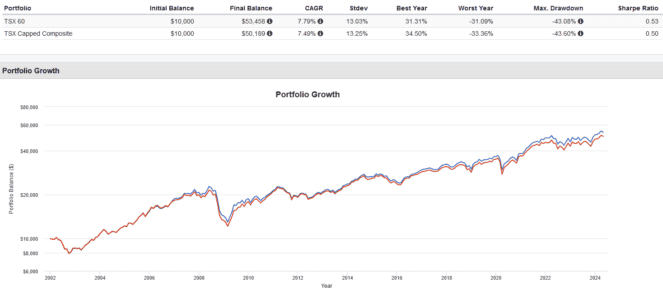

While this broader index might seem like an attractive option due to the potential for higher returns, historical data suggests it doesn’t necessarily outperform and tends to introduce more volatility into an investment portfolio.

From the image provided, which compares the growth of investments in the TSX 60 and the TSX Capped Composite from 2002 to 2024, it’s clear that the TSX 60 has consistently performed well with less volatility.

Both indexes experienced similar dips and recoveries, but the TSX 60 has shown a slightly better recovery and less pronounced drops, especially in turbulent market periods. Why? Well, it excludes many of the more speculative small-cap mining and oil companies the TSX Capped Composite has.

For investors aiming to focus on stable, well-established Canadian companies, the TSX 60 offers a less volatile avenue with a concentration on the largest and most secure blue-chip stocks.

Why ZIU?

I like ZIU because compared to its older competitor from iShares, it is less expensive. Whereas the latter charges a 0.18% management expense ratio, ZIU undercuts it at 0.15%. Keep in mind that you’re getting the same exposure.

What else does ZIU provide? Quarterly dividend payments (the yield is still yet to be decided as this is a newer ETF, but I anticipate it to be around 3%). It’s also very liquid — you shouldn’t have issues buying and selling it like any normal stock.

I also anticipate it to be very tax-efficient. Given that virtually all of its holdings are Canadian-listed companies, the distributions from this ETF will likely be comprised of eligible dividends, which are subject to lower rates.