We’d all love to own that stock that transforms our lives, making us extremely wealthy. While there have been many that have done that throughout history, it’s so much easier to see it with hindsight. This is because there are always so many risks and uncertainties involved. In this article, I’ll discuss an undervalued stock that I believe has significant upside and that I believe can make many millionaires.

Ballard Power’s long journey

As Canada’s leading fuel cell manufacturer, Ballard Power Systems (TSX:BLDP) has seen a lot. It all started in 1979 when Ballard Research Inc. was founded by Geoffrey Ballard. The search for environmentally clean energy systems has included many false starts and struggles. Yet, Ballard survived it all — a testament to the company and its fuel cell technology.

Of course, there are real risks. This is a new technology that is aiming to disrupt the gasoline economy. The hurdles are great, but so is the product and the goal. Today, the value proposition of fuel cell engines has been validated. They have zero emissions, rapid refuelling, long ranges in all weather conditions, and scalable refuelling infrastructure.

Ballard’s first quarter

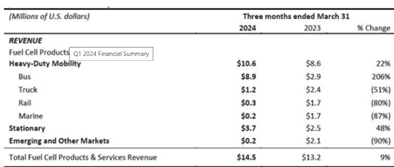

Earlier this month, Ballard reported its first quarter 2024 result. The quarter was not remarkable from a financials perspective, but because of the progress that the company is making, which seems to be accelerating. For example, revenue increased 9% to $14.5 million.

Breaking this down, Ballard’s bus vertical saw revenue increase 206%, and its stationary vertical saw revenue increase 48%. This is significant, and it’s expected to continue strong. In fact, Ballard’s backlog increased 38% since then relative to the fourth quarter (Q4), to $180.5 million. The fourth quarter of 2023 saw a record order intake of $64.7 million, and the first quarter of 2024 saw another record order intake of $64.5 million. New orders totalled $130 million in these two quarters, a record for any six-month period.

This was accompanied by a 3.6% improvement in gross profit and a 12% improvement in the company’s gross margin. The company continues to post net losses, but this is real progress.

On the negative side, the company’s cash burn is currently approximately $20 million per quarter. With $720 million of cash on the balance sheet, Ballard has some time before it needs additional funding. For now, the gross margin will approach break even by Q4, and Ballard has been pursuing cost reductions quite successfully.

Looking ahead: Why Ballard is an undervalued stock

Now, let’s see what Ballard has in store for it. After the quarter ended, on April 1, Ballard announced the largest order in its history — 1,000 fuel cell engines to power Solaris’s buses in Europe. This is a multi-year supply agreement for deliveries through to 2027. The order is a testament to the performance of the engines, and it further advances the adoption of fuel cell buses in Europe.

The scaled deployment of fuel cell buses in the medium term will drive improved economics. Ballard currently has approximately 1,200 fuel cell engine orders in Europe and North America — management sees this tripling in the next two to three years. There are currently approximately 600 fuel cell buses in Europe and North America — management sees this increasing to the thousands in the next three to four years.

Clearly, the outlook for Ballard’s bus vertical is very positive. But this doesn’t even scratch the surface of the market potential for its fuel cells. Ballard’s other verticals, such as the rail, truck, and stationary verticals, are also significant, and they offer additional upside for the company.

The bottom line

Ballard Power is finally making real progress toward its goal of providing an environmentally clean energy system. Governments are finally ready for this and are taking action. This, combined with the evidence that fuel cells are a viable solution, is increasingly leading to fuel-cell adoption for many heavy-duty vehicles.

Ballard’s stock price has fluctuated throughout its history. Today, it’s trading below $5. If this momentum in the company’s order books continues, we’ll see just how undervalued Ballard is. The market for fuel cells is enormous, and Ballard is well set up to be a big beneficiary.