Are you on the hunt for high-yield dividend stocks to buy? Some Canadian companies with long-established histories of consistent dividend payments are on sale today — some fetching the lowest valuations seen in half a decade. Dividend Aristocrats, including BCE (TSX:BCE), Enbridge (TSX:ENB) stock, and First National Financial (TSX:FN) stock, are trading at bargain prices right now, offering attractive entry points for savvy investors seeking high-yield passive income through steady dividends.

Enbridge stock: A bargain hunter’s favourite high-yield play

Enbridge is a $104 billion North American energy transporter whose vast networks of oil and gas pipelines may continue to generate recurring cash flows for another generation. ENB stock offers a high-yield dividend of 7.4% alongside capital-appreciation potential as its enterprise value recovers to historical averages.

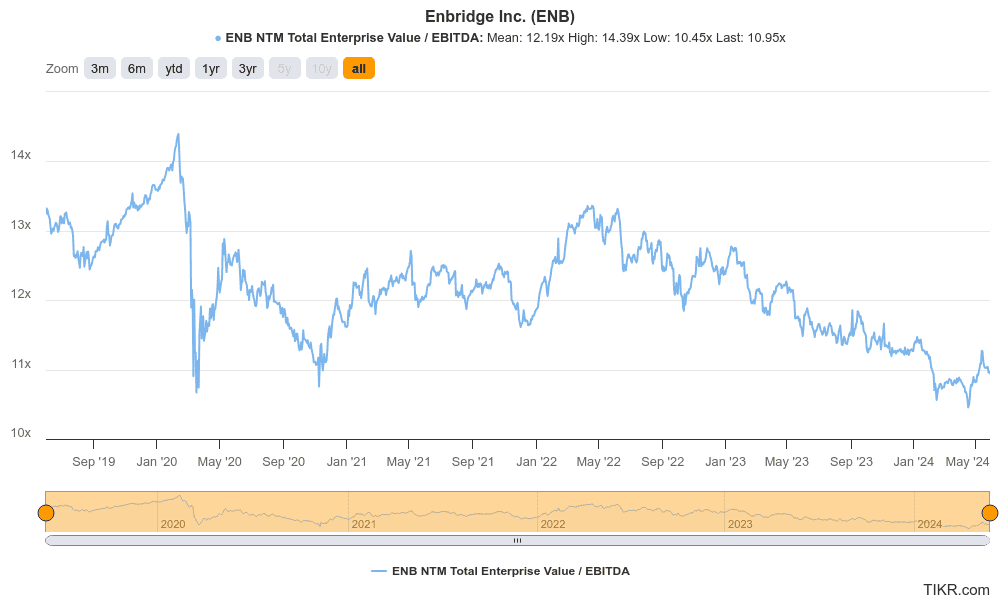

Pressure from higher interest rates and persistent energy market uncertainty weighed on Enbridge stock over the past few years. The company’s forward enterprise value-to-earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) multiple has fallen back to 2020 pandemic levels.

Enbridge stock’s forward EV/EBITDA multiple of 10.95 is well below its five-year average of 12.19. Bargain hunters may scoop the cash flow generating machine at its lowest valuation in half a decade before shares recover to their average valuation ranges.

What’s more, Enbridge is committed to its dividend, which it raised each year over the past 28 years. The company recently reported an 11% year-over-year growth in adjusted EBITDA and a 9% increase in distributable cash flow during the first quarter of 2024. Shares could gain recovery momentum this year.

BCE stock

In a recent regulatory ruling, Canadian telecommunications giant BCE got a raw deal that opened up its expansive fibre network to competitors. Lower expected future cash flows and rising financing costs in a high interest rate environment have weighed BCE’s stock price down to bargain levels in 2024, pushing its dividend yield beyond 8.7% annually.

Bargain hunters can buy BCE stock at a forward EV/EBITDA multiple of 7.6 today. The $41.6 billion telecom business has only been this cheap during a severe market crisis of 2020 when COVID-19 hit North America.

Should you buy BCE stock for its lucrative, high dividend yield? BCE runs a resilient business that grew operating earnings (adjusted EBITDA) during the first quarter and generated positive free cash flow as the company celebrated its best retail internet net additions in 17 years. Management remains committed to BCE’s dividend in recent years, despite free cash flow shrinking as the company aggressively invests in expanding its networks.

Although the risk to BCE’s high-yield dividend remains apparent, management seems keen to retain BCE stock’s Dividend Aristocrat status and may choose to cut back on its aggressive investment drive and maintain its dividend intact for longer.

First National Financial stock: A passive-income champion facing temporary assaults

First National Financial is a $2.2 billion non-bank lender that leverages its key position as Canada’s largest non-bank mortgage financier to book high-volume business. FN boasts more than $145 billion in mortgages under administration, and the high-yield dividend stock is committed to sharing recurring income from the portfolio through monthly dividends to stock investors.

Why has FN stock fallen behind its fair value? Aggressive competitors have been offering discounted rates and higher broker incentives to undercut FN and gain market share. The lender’s residential mortgage originations dropped during the most recent quarter. Its experienced management team responded by maintaining its pricing discipline; they believe price aggression is unsustainable for the competitors — just as in previous pricing battles. The business should continue to thrive in its highly competitive but familiar environment. However, the stock price has fallen to reflect current bad times, which should be temporary.

FN stock’s price-to-earnings (P/E) multiple has dropped below 8.3 — its lowest level since 2020. Shares are cheaper than they have been in four years.

FN PE Ratio data by YCharts

Should you buy it? First National Financial stock pays a regular monthly dividend yielding 6.7% annually and usually declares a special payout towards year-end. A repeat of last year’s $0.75 per share special dividend could lift the annual yield beyond 8.8% — a lucrative deal for investors seeking passive income.

FN stock has religiously raised its dividends for 12 consecutive years and counting while maintaining a conservative earnings payout rate of 55%.