If you’re looking for an exchange-traded fund (ETF) to track companies listed on the Toronto Stock Exchange (TSX), you have many options.

Popular choices often target indices like the S&P/TSX 60 or its more diversified counterpart, the S&P/TSX Capped Composite.

However, I’m not keen on these typical selections for various reasons, which I’ll explain. Instead, I prefer an ETF that focuses on a portfolio of TSX-listed Dividend Aristocrat stocks.

Here’s why I believe this strategy could be the smartest way to invest $1,000 in an ETF right now.

The TSX has some weird exposures

When you invest in the usual TSX indexes, you’re essentially accepting a skewed exposure to different sectors, some of which may be significantly overweight while others are underrepresented.

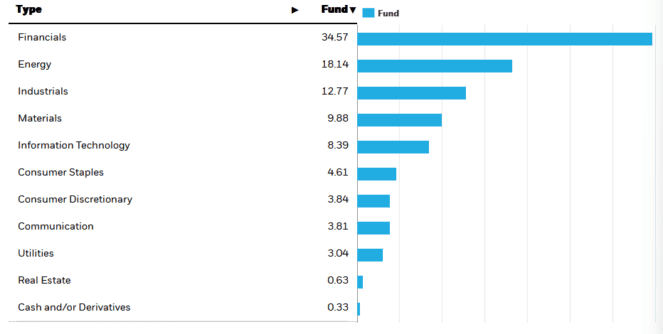

For example, by buying into indices like the S&P/TSX 60, you find yourself heavily weighted towards financials, including banks and insurance companies, which constitute 34.5% of the index. Energy sectors, including pipelines and producers, are also over-represented at 18.14%.

However, these indices offer surprisingly little exposure to other important sectors.

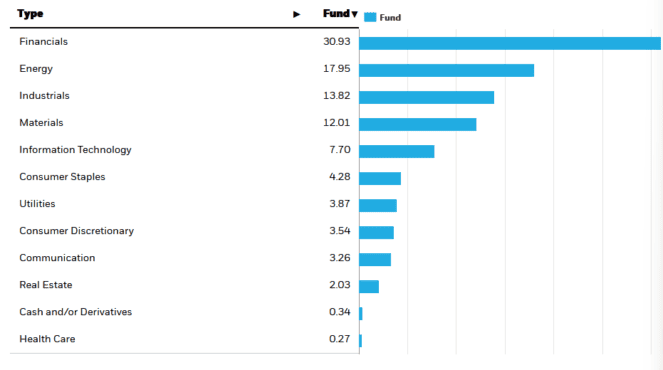

Real estate, for instance, makes up only a tiny fraction of the TSX 60 at 0.63%, and even in the more broad-based S&P/TSX Capped Composite, it only increases to 2.03%.

Similarly, consumer staples, consumer discretionary, communications, and utilities each account for less than 5% of these indices.

This unbalanced sector distribution can lead to a portfolio that may not align with your investment goals or risk tolerance, especially if you’re seeking a more diversified or sector-balanced approach.

My TSX ETF pick

My top pick to invest $1,000 in is iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSX:CDZ).

This ETF specifically targets Canadian companies that have demonstrated a commitment to increasing dividends, with a requirement for inclusion being at least five consecutive years of dividend growth.

This criterion not only filters for reliability and stability in dividend payments but also for overall corporate health.

What sets CDZ apart is its sector diversification. Unlike the typical TSX indices, the financial sector and energy sector concentrations are considerably lower in CDZ, at 29.77% and 11.67% respectively.

This ETF offers a more balanced exposure across various sectors, reducing the risk associated with over-concentration in financials and energy.

Additionally, CDZ provides a solid distribution yield of 4.14% as of June 5, and uniquely, it distributes this yield on a monthly basis. This feature makes it particularly attractive for investors seeking regular income streams.